See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Fork in the Cryptographic Road So bitcoin forked. You did not know this. Well, if you’re saving in gold perhaps not. If you’re betting in the crypto-coin casino, you knew it, bet on it, and now we assume are happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of bitcoins; bitcoin has no yield. Bitcoin simply sells for a greater quantity of dollars now than it did before. But who wants to sell? Bitcoin is going to a million bucks — at least. So bitcoin, whatever it is, forked. Whatever forking is. To understand these two concepts, let’s consider an analogy. Picture a

Topics:

Keith Weiner considers the following as important: Bitcoin, Chart Update, dollar price, Featured, Gold, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver, silver basis, Silver co-basis, silver price, Virtual Currencies

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

A Fork in the Cryptographic RoadSo bitcoin forked. You did not know this. Well, if you’re saving in gold perhaps not. If you’re betting in the crypto-coin casino, you knew it, bet on it, and now we assume are happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of bitcoins; bitcoin has no yield. Bitcoin simply sells for a greater quantity of dollars now than it did before. But who wants to sell? Bitcoin is going to a million bucks — at least. So bitcoin, whatever it is, forked. Whatever forking is. To understand these two concepts, let’s consider an analogy. Picture a bank, the old-fashioned kind. Call it Acme (sorry, we watched too much Coyote and Road Runner growing up). A group of disgruntled employees leave. They take a copy of the book of accounts. They set up a new bank across the street, Wile E. Bank. To win customers, they say if you had an account at Acme Bank, you now have an account at Wile, with the same balance! |

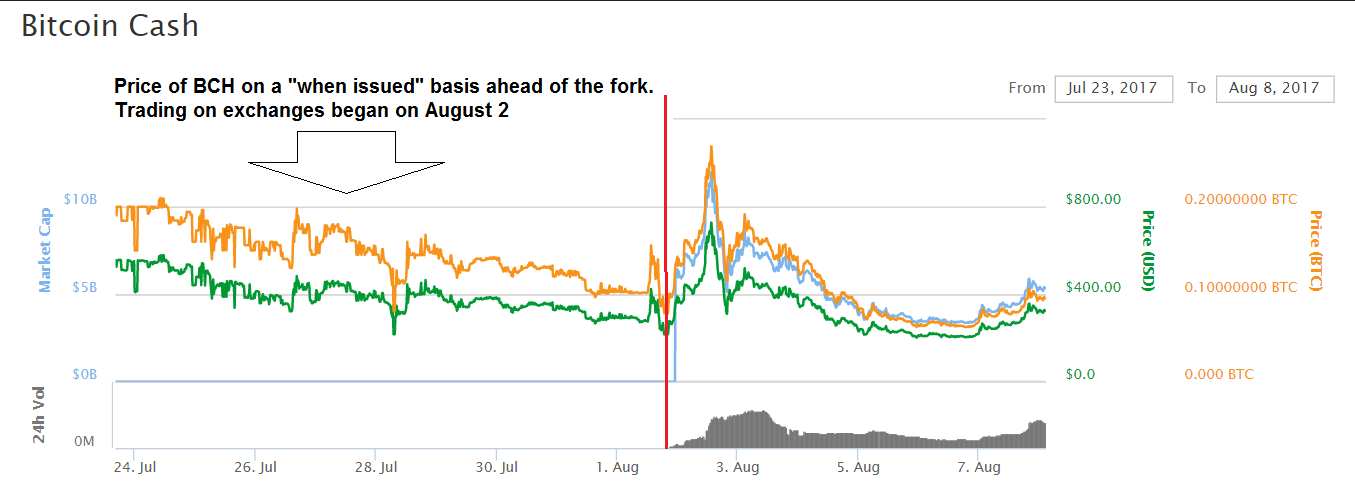

Bitcoin daily 2017(see more posts on Bitcoin, ) Bitcoin, daily – adding the current price of BCH (the new type of Bitcoin all holders of BTC can claim at a 1:1 ratio), the gain since the “fork” amounts to roughly $1,000 at the time we write this. So far the chart of BTC in USD terms since 2010 happens to be a spitting image of the chart of gold in USD terms from 1973-1979 (the pattern similarity is eerie). A brief explanation of the “hard fork”. [PT] - Click to enlarge |

| Is this just the sort of evil thing a greedy bankster would do? Do we need regulation to keep them from doing it (is it even illegal currently)? No, it’s actually impossible. The problem is that Wile E Bank doesn’t have the assets. It does not have the bills and bonds and loans payable to Acme. So it would be suicide to take on the liabilities. It would be nothing more than offering free money to people.

Of course, no one would to do that. It would not be a crime, but an act of altruism. Or perhaps an act of “Wile E. Coyote, Super Genius.” Yet, this is what happened with bitcoin. Bitcoin Cash set up across the street (so to speak). Anyone who had a bitcoin balance as of the moment of the fork — when the Coyote and his posse set up shop — has the same bitcoin cash balance now. To understand how this could be possible, we have to drill down into what makes a currency, a currency. Most in the gold and bitcoin communities would agree on one thing. The dollar is a fiat currency. People use it, because the government has various ways to force them to (including especially a monopoly in schools). The bitcoin people will tell you that bitcoin is not a fiat currency. And they are right. It’s true, no government forces anyone to use bitcoin (if anything, it’s the opposite). This does not give us enough resolution to see the issue clearly, so let’s keep going deeper. The dollar is not only fiat, but also irredeemable. That means the issuer of the currency will not redeem it for a fixed amount of money. And let’s explain that statement, which may seem rather cryptic (OK, pun intended). |

Bitcoin Cash, July - August 2017(see more posts on BTC-USD, ) |

| At the time America was founded, there was no question that money meant gold and silver. And when you deposited money in the bank, there was no question that you were entitled to get back the same amount.

The dollar was merely a way of standardizing the size of the deposit, so that it was consistent from bank to bank and therefore anyone could read any bank’s or any company’s financial statements. It’s better if everyone agrees on how long a foot is, how much weight is in a pound, how much time is in a second. And how much gold is in a dollar. By a slow process of erosion, in many incremental steps over two centuries, the government severed any link between the dollar and gold. After 1933, the dollar was not redeemable in gold by the American people. After 1971, it was no longer redeemable even by central banks. |

You can exchange the dollar for anything else, including gold. But there is no contractual obligation of the issuer to redeem it for a fixed amount of gold or else be declared bankrupt. And we see that the terms of exchange, including the price, are constantly changing. And the change is generally adverse to those who hold dollars.

Bitcoin, like the dollar, is irredeemable. It can be exchanged for most things, including gold. But there is no issuer per se, not to mention a contractual obligation by any issuer to redeem for an agreed amount of gold.

However, there is another key concept which differentiates the dollar and bitcoin. That concept is backing. The dollar is a liability, backed by an asset. Yes, it is true that the backing is debt (government and corporate bonds primarily), and this debt is payable in dollars. Which is backed by this debt. It is a circular system, and would surely be a criminal activity if done by private, for-profit actors.

However, for every single dollar you or anyone may have, there is a debtor who is working to pay — or at least service — his debts. Every debtor must sell goods or services of some kind in exchange for dollars, to pay the monthly vig. Or else.

Or else what? If he doesn’t pay, that is called a default. And in defaulting, he will lose his home, car, business, etc. The threat of taking away someone’s business or home makes them quite highly motivated to sell whatever they have to, in order to raise enough cash to keep servicing the debt.

This explains why the dollar has retained so much value, why its value is as stable as it is, and why manufacturers are more and more aggressive in selling better and better stuff.

It is commonly accepted to say the dollar is “printed”, but we can see from this line of thinking that it is really borrowed. There is a real borrower on the other side of the transaction, and that borrower has powerful motivations to keep paying to service the debt.

Bitcoin has no backing. Bitcoin is created out of thin air, the way people say the dollar is. The quantity of bitcoins created may be strictly limited by Satoshi’s design. It is possible for bitcoin to fork, because it is not backed by any asset.

The blockchain is an important new technology. It is a public ledger that can record anything, with each record indelibly stamped with the date and the recording party. This is useful to record assets. It could revolutionize supply chain management, for example making it possible to track food from farm to table.

But something must be emphasized here. A ledger is useful for recording something, but bitcoin is only a recording of itself.

So in this light, it should be clear why a new bank cannot just offer free dollar (or gold) accounts. The old bank has a bunch of assets, say $1.1 million. And a bunch of liabilities, say $1 million. The new bank would declare $1 million in new liabilities but it would have no assets at all.

For 46 years, the dollar has been perfectly irredeemable. However, it is backed by bonds. Bitcoin is not only irredeemable, but also unbacked. That is a big difference — in favor of the dollar.

We have heard bitcoin proponents defend this by saying this is better because there is no risk of loss of the assets. This is akin to saying that being dead is better than being alive, because there is no risk of death.

Being unbacked and irredeemable, bitcoin is just a number in a ledger. Well, now two numbers in two ledgers. Bitcoin and bitcoin cash forked, remember?

We are not here to prognosticate on the bitcoin price. It may or may not be a good speculation today. However, we want to observe one thing. There are small unsound structures, such as a Jenga tower just before someone pulls the last stick. There are big unsound vehicles, such as the RMS Titanic sailing in the iceberg-infested waters of the North Atlantic Ocean. And there are the… pugnacious… systems such as bitcoin.

The boldness of bitcoin’s promoters is matched by the unsoundness of bitcoin’s monetary design (as opposed to the technological soundness of the blockchain). This combination will result in devastating losses to whomever is left holding the bag at the end.

Usually, there is no opportunity to call out these things. Or else, one looks at the crowd of believers, and decides discretion is the better part of valor. But this week, bitcoin forked. This is now the time to say that forking is proof that bitcoin as presently constituted is unsound. The crypto emperor is naked.

We want to clarify one thing. We are not saying that anyone involved in bitcoin is a dishonest person. The principles of monetary economics are not obvious, and we do not fault anyone for participating in the bitcoin market or for thinking that bitcoin is money.

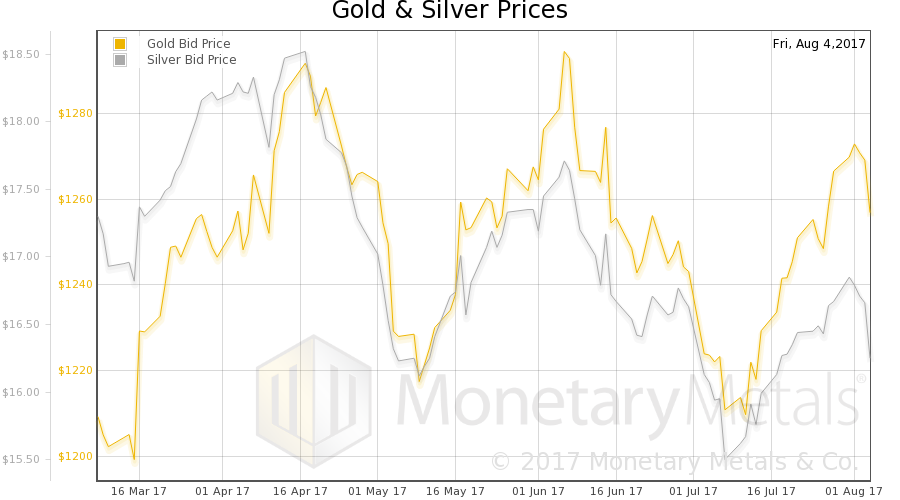

Fundamental DevelopmentsThe prices of the metals came down this week, especially silver on Friday, which was -2.7%. Was it manipulation? We doubt it. The manipulators were away from the metals markets this week… something about a fork in another money market which we’ve been told is a bigger threat to the hegemony of the Federal Reserve. Was is speculators taking profits and getting out of their silver positions? Was it softness in the market for actual metal? Below, is a graph of the silver action on Friday. And also graphs of the true measure of the fundamentals. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio. |

Gold and silver prices(see more posts on gold price, silver price, ) |

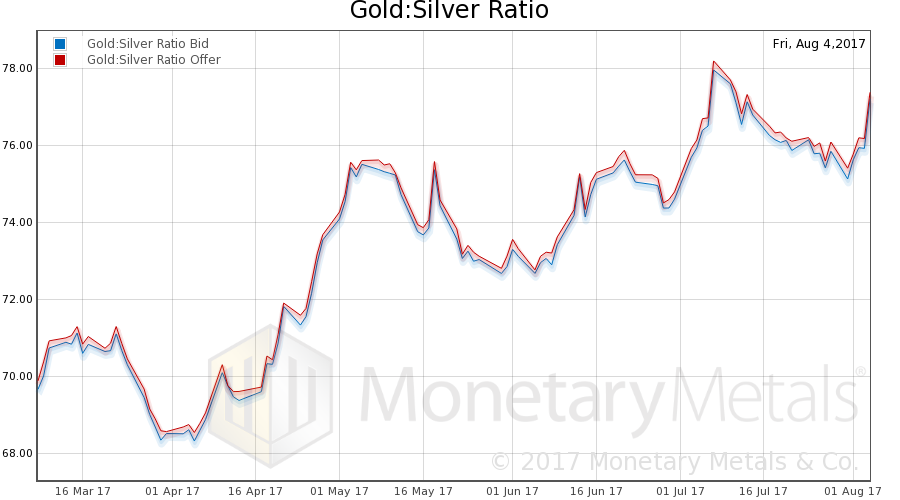

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up this week, especially on Friday. We find it interesting that the ratio did not fall farther.

|

Gold-silver ratio, bid and ask(see more posts on gold silver ratio, ) |

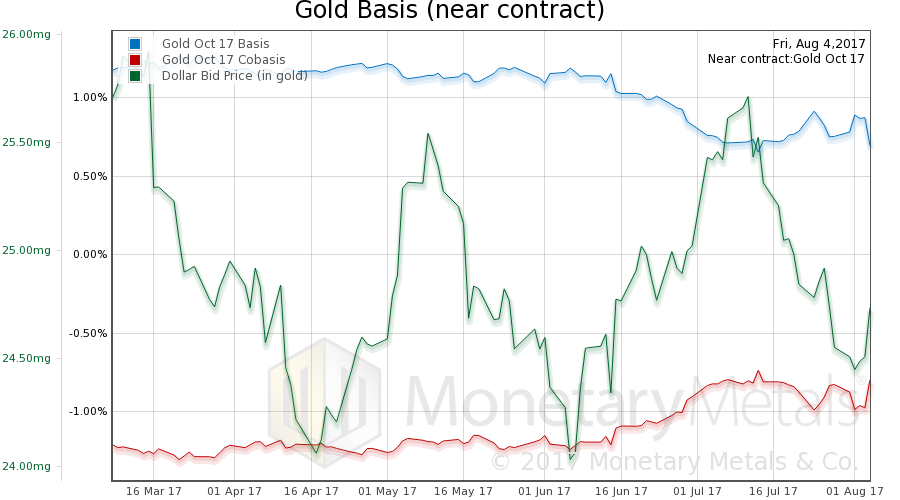

Gold basis and co-basis and the dollar priceHere is the gold graph. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

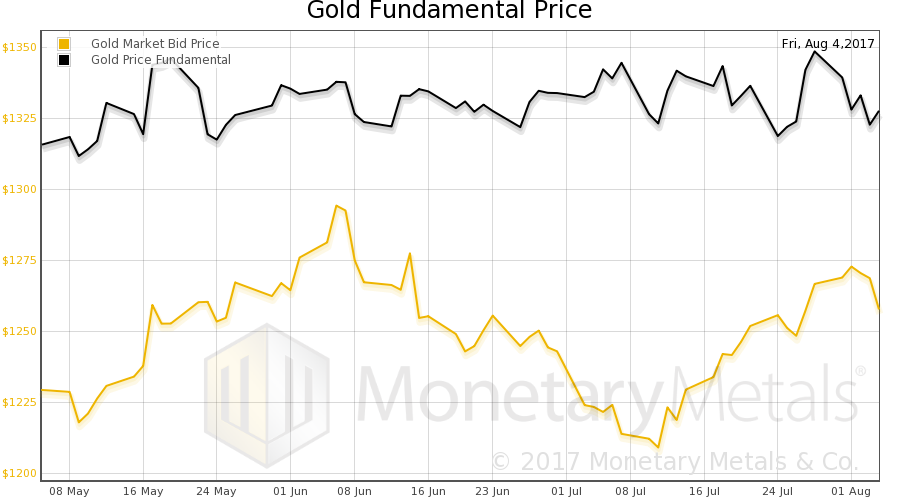

Gold Fundamental PriceThe dollar rose a bit this week (the mirror image of the falling price of gold). As the dollar rose, the co-basis increased. Gold became a bit scarcer. Our calculated gold fundamental price fell by about $20. |

Gold Fundamental Price |

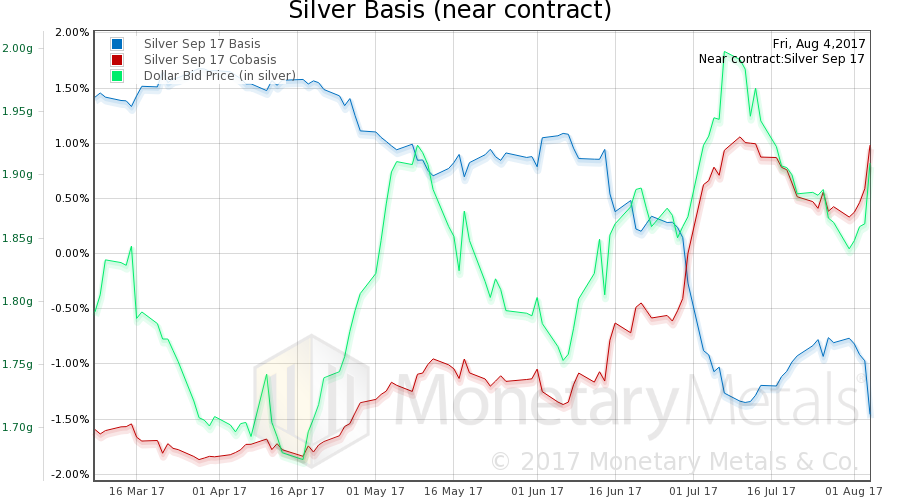

Silver basis and co-basis and the dollar pricedNow let’s look at silver. In silver, the move up in the co-basis is greater. Keep in mind that we are approaching the expiry of the September silver contract, which has been in temporary backwardation for over a month. |

Silver basis and co-basis and the dollar priced(see more posts on dollar price, silver basis, Silver co-basis, ) |

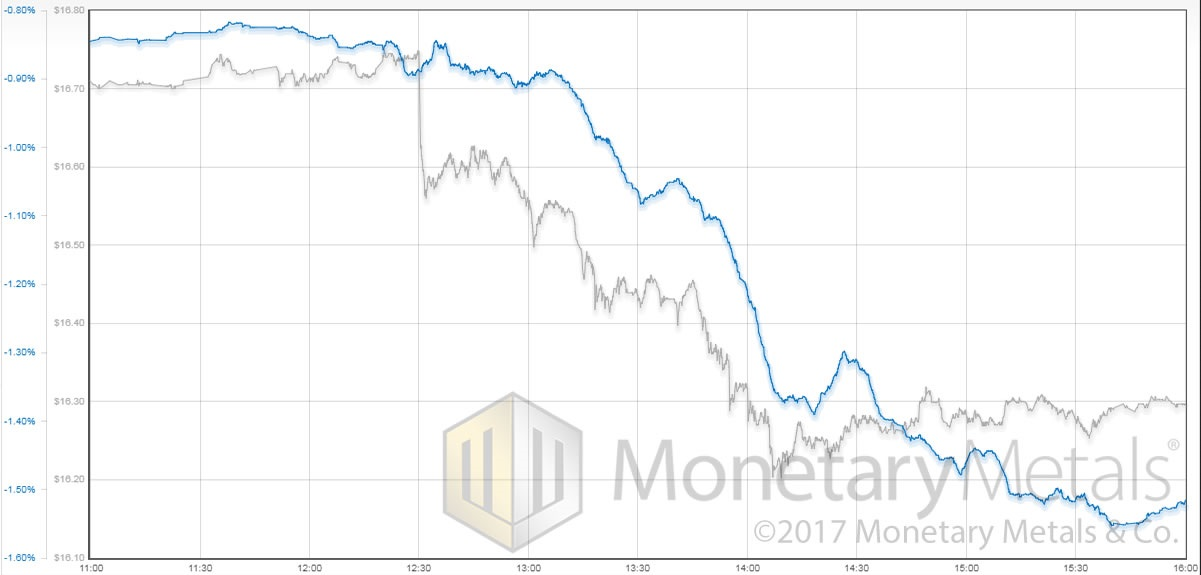

Silver basis and silver priceThe continuous basis in silver moved up as well, but not so much. Our calculated silver fundamental price fell a few pennies. Here is a graph of the September silver basis overlaid with price for Friday, showing the drop from around $16.70 to below $16.30. Notice how the event began. At 12:30 (GMT), the price began dropping. But the basis is not really responding. This is even selling of both metal and futures. Slowly at first, the basis moves down, and continues even after the price stabilizes and begins a slow rising trend a little after 14:00. This is speculators getting with the program, and selling. No one wants to hold an asset that’s going down! This is a relatively big move in the basis, around 70bps. So is the silver sell-off over? It’s hard to tell. The fundamentals were firming this week — the fundamental price did not move down much during the move, by just -$0.09 from Thursday to Friday. On the other hand, speculators may be putting in sell orders over the weekend and may decide to bail out on Monday. Momentum can be self-fulfilling. |

Silver basis and silver price(see more posts on silver basis, silver price, ) |

© 2017 Monetary Metals

Charts by Cryptowatch, coinmarketcap and Monetary Metals

Chart and image captions by PT

Tags: Bitcoin,Chart Update,dollar price,Featured,Gold,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver,silver basis,Silver co-basis,silver price,Virtual Currencies