Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationThere are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.EM local-currency bonds continue to look tempting. Any short-term pullback could be a chance to buy this asset class.CommoditiesWe see the current equilibrium oil price at USD55/b, and our scenario is for it to remain around

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationThere are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.EM local-currency bonds continue to look tempting. Any short-term pullback could be a chance to buy this asset class.CommoditiesWe see the current equilibrium oil price at USD55/b, and our scenario is for it to remain around

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

- There are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.

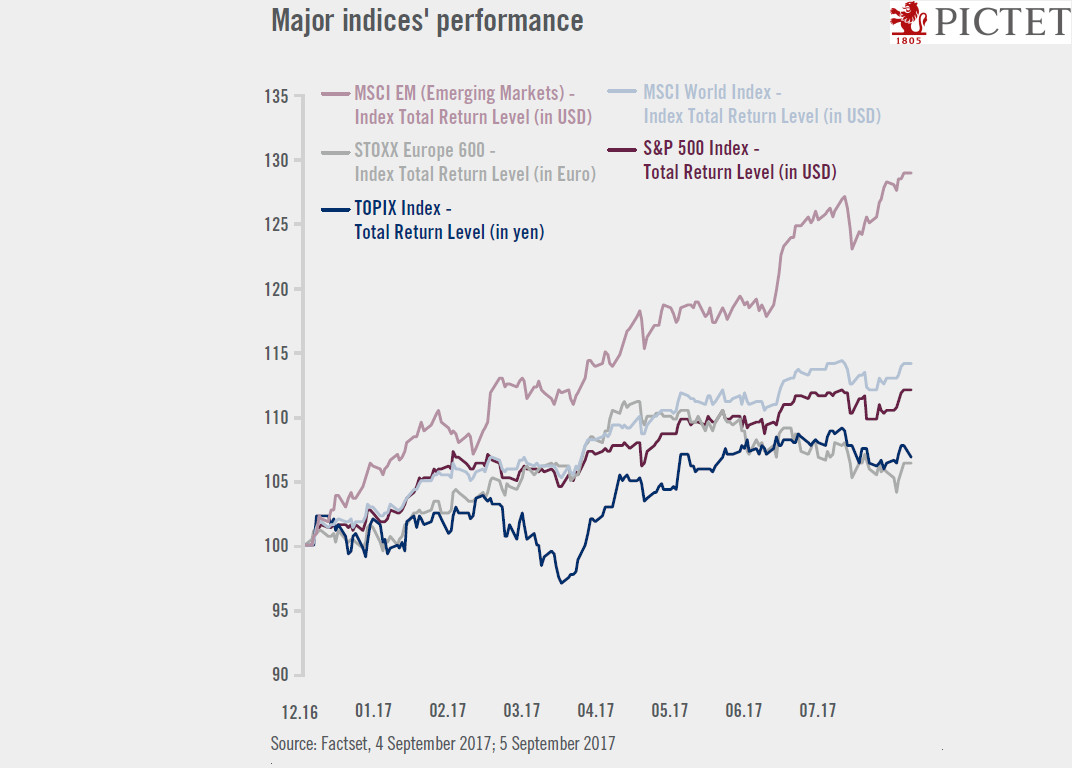

- We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.

- Low correlations and a pick-up in disruptive M&A mean a good environment for active management.

- EM local-currency bonds continue to look tempting. Any short-term pullback could be a chance to buy this asset class.

Commodities

- We see the current equilibrium oil price at USD55/b, and our scenario is for it to remain around this level over the next 12 months.

Equities

- Equities are likely to mark a pause until a new catalyst emerges.

- As we move through the remainder of 2017, markets will increasingly focus on the earnings outlook for 2018; we expect mid-single-digit earnings growth next year, still good but less so than in 2017.

Currencies

- We still expect a modest rebound in the USD in the final months of 2017, given extreme negative positioning. But our new estimate for the EUR/USD rate for end-2018 is 1.24, compared with a level of 1.19 at end-August.

- We have revised our year-end target for the US Treasury yield from 2.8-3% to 2.5%. As we still expect yields to rise, we will stay underweight core sovereign bonds and short duration.

- Despite high prices, we continue to prefer euro corporate credit over US, because of differences in the economic cycle, market complacency about Fed policy tightening, and our expectation that QE tapering from the ECB will be gradual.

- We expect US high yield spreads to widen, from 385 bp at the end of August to around 420 bp by the end of 2017.

Alternatives

- Conditions continue to favour hedge funds, notably long/short equity strategies.

- Valuations, competition and capital inflows remain high in Private Equity, but there are still good opportunities for attractive returns. China is becoming increasingly hard to ignore in this space.

- In Real Estate, investors should tread with caution, but look at distressed opportunities in retail, and at logistics (the main beneficiary of shifting retail trends).