Household formation trends mean the housing sector is unlikely to make a meaningful contribution to US GDP.The recently released Census Bureau’s Annual Social and Economic Supplement (ASEC) brought sobering news for the US housing market: new household formation slowed significantly, to 405,000 in 2016, the lowest level since 2009 (+357,000), compared with 1,232,000 in 2015. In other terms, the number of households grew only 0.3% last year, compared with +1.0% in 2015.In general, household formation has softened since the Global Financial Crisis (GFC), which seems to have triggered a genuine regime shift. Birth rates and labour force growth have also dropped since the GFC, coinciding with slowing immigration. In other words, demographics have not followed the considerable improvement in

Topics:

Thomas Costerg considers the following as important: Macroview, US demographics, US GDP growth, US household consumption, US housing, US labour market

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Household formation trends mean the housing sector is unlikely to make a meaningful contribution to US GDP.

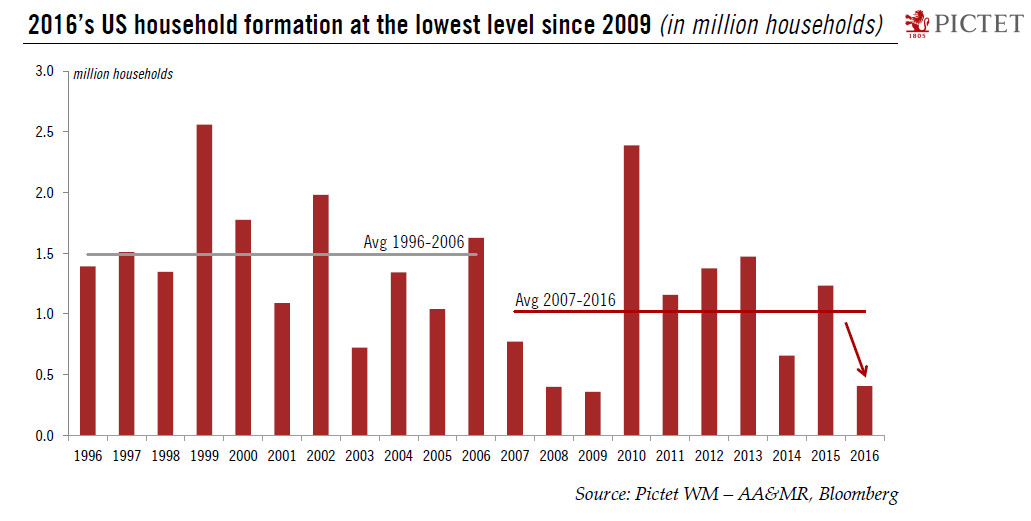

The recently released Census Bureau’s Annual Social and Economic Supplement (ASEC) brought sobering news for the US housing market: new household formation slowed significantly, to 405,000 in 2016, the lowest level since 2009 (+357,000), compared with 1,232,000 in 2015. In other terms, the number of households grew only 0.3% last year, compared with +1.0% in 2015.

In general, household formation has softened since the Global Financial Crisis (GFC), which seems to have triggered a genuine regime shift. Birth rates and labour force growth have also dropped since the GFC, coinciding with slowing immigration. In other words, demographics have not followed the considerable improvement in the GDP picture since the GFC. Household formation dropped from an average of 1,490,000 between 1996 and 2006, to 1,020,000 per year between 2007 and 2016. In the three years to 2016, the annual average fell to 764,000.

This data is of particular significance for the housing market. New household formation provides crucial underlying support for new home sales, which have averaged 592,000 in the past 12 months. While there might be still some upside potential for new home sales in the near term, growth could tail off given the structural softness in household formation, in our view. Put differently, housing is unlikely to provide much support to US economic growth going forward. We forecast that housing (4% of US GDP) will grow only 1.8% in 2017 and 1.0% in 2018, down from +5.5% in 2016 and an average of +8.5% between 2013 and 2015.