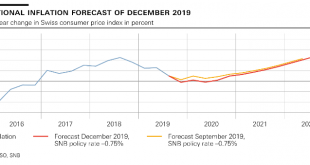

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The expansionary monetary policy continues to be necessary given the inflation outlook in Switzerland. The trade-weighted exchange rate of the Swiss franc...

Read More »Europe chart of the week – Swiss franc

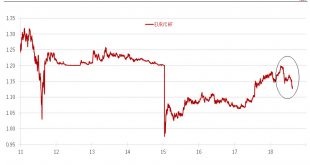

Recent foreign exchange movements pave the way for a cautious SNB monetary policy.In April, the EUR/CHF rate (1 euro in Swiss franc) hit its highest level since the Swiss National Bank (SNB) decided to lift its exchange rate floor in January 2015. Since then, the Swiss franc has appreciated by 5.8% against the euro, mainly driven by political uncertainty in Italy and concerns that Turkey’s economic troubles could impact European banks.Movements in the foreign exchange (FX) markets are...

Read More »SNB Monetary policy assessment of 15 March 2018

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank. SNB FX Intervention In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held...

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank.In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB. The SNB does not communicate on its interventions in the...

Read More »Increasingly optimistic on Swiss outlook

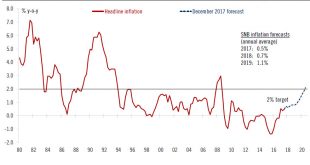

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between – 1.25% and-0.25% and the interest rate on sight deposits at a record low of – 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency...

Read More »Increasingly optimistic on Swiss outlook

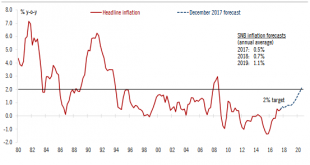

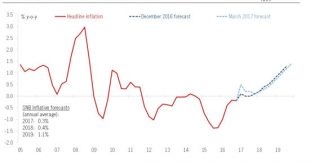

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.The SNB’s monetary policy assessment reflected an improvement in the outlook since its September...

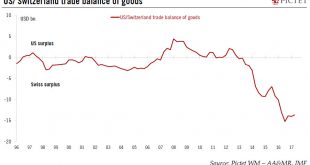

Read More »Switzerland not far from being deemed a ‘currency manipulator’ by the US

Switzerland fulfils two of the three criteria required to be considered a currency manipulator by the US, but it is unlikely to affect the SNB’s monetary policy stance.In the next few days, the U.S Department of Treasury will publish its semi-annual report on International Economic and Exchange Rate Policies. Switzerland is one of six countries on the department’s monitoring list, as it meets two of the three conditions established by the US Treasury to be deemed a ‘currency manipulator’....

Read More »No hint of Swiss rate rise

The Swiss National Bank left monetary policy unchanged at its latest meeting and forecast that the Swiss economy would grow 1.5% in 2017.At its latest policy meeting on 16 March, the Swiss National Bank (SNB) left the interest rate on sight deposits at a record low of -0.75% and the central bank reiterated its willingness to intervene in the foreign exchange market if needed, “taking the overall currency situation into consideration”, as it had mentioned in its previous press release. The...

Read More »Strong Swiss growth lessens chance SNB will act

Macroview Stronger-than-forecast growth means the central bank is unlikely to alter monetary policy this month Switzerland: Real GDP Growth Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org