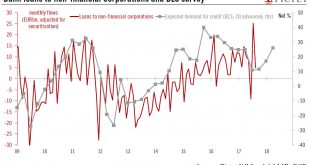

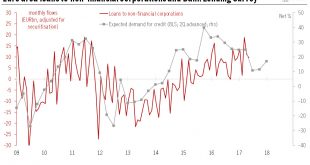

The latest ECB's lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.Net demand for bank loans to enterprises increased further in Q3, in line with banks’...

Read More »Euro area: Bank credit standards eased slighlty in Q2

The latest Bank Lending Survey from the ECB showed that credit standards for loans to enterprises eased slightly in net terms in Q2. Our GDP growth forecast for the euro area remains unchanged. The July Bank Lending Survey (BLS), released by the ECB today, showed that bank credit standards for loans to enterprises eased slightly in Q2 2017, following a net easing in the previous quarter. This came despite expectations in the previous survey round that these standards would tighten...

Read More »EA: Bank credit flows rose again in May

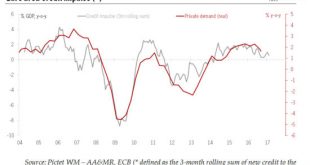

Euro area M3 and credit flows for May were pretty strong overall. Our GDP growth forecast remains unchanged for the euro area.Euro area credit flows to non-financial corporations increased again in May, by EUR10 bn in adjusted terms, following a gain of EUR11 bn in April.Broad money growth (M3) rose marginally from 4.9% to 5.0% y-o-y. Bank lending growth to the private sector was broadly unchanged at 2.6% y-o-y, in line with leading indicators.Overall, we are keeping unchanged our GDP growth...

Read More »Euro bank credit still strong in spite of February weakness

But today's credit report means ECB will have to tread carefully when it comes to reducing the degree of monetary accommodation.The euro area M3 and credit report for February was slightly disappointing overall. Broad money growth (M3) eased from 4.8% to 4.7% y-o-y. Bank loans to non-financial corporations fell back to 2.0% y-o-y in February, from 2.3% in January, as a result of weaker lending flows across the region.Notwithstanding this modest setback, the euro area credit cycle remains...

Read More »Softer credit flows in the euro area

Macroview Credit flows to households and corporations slackened in August, so domestic demand may be less of a factor in near-term growth. But we are sticking to our full-year growth forecast for the euro area. Credit to euro area households increased in August. Although at a slower pace than the previous month, August was the 23th straight month of positive credit flows. By contrast, bank credit to euro area non-financial corporations (NFCs) declined by EUR1 bn in August (adjusted for sales...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org