The Australian and New Zealand dollar are among the most expensive currencies. The former looks especially vulnerable to a mild pullback.At their November monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at, respectively, 1.50% and 1.75%.The RBA sounded relatively cautious given low wage growth and high household debt. The RBNZ was more upbeat in light of the potential for more fiscal stimulus under the new coalition government and the recent sharp NZD depreciation. However, a rate hike remains highly unlikely in either country in the first half of 2018.Antipodean currencies tend to be highly influenced by interest-rate differentials (see chart 1) and trends in the commodity market. With the Fed

Topics:

Luc Luyet considers the following as important: Australian central banks, Australian Dollar, central bank policy, currencies, Macroview, New Zealand dollar

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

The Australian and New Zealand dollar are among the most expensive currencies. The former looks especially vulnerable to a mild pullback.

At their November monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at, respectively, 1.50% and 1.75%.

The RBA sounded relatively cautious given low wage growth and high household debt. The RBNZ was more upbeat in light of the potential for more fiscal stimulus under the new coalition government and the recent sharp NZD depreciation. However, a rate hike remains highly unlikely in either country in the first half of 2018.

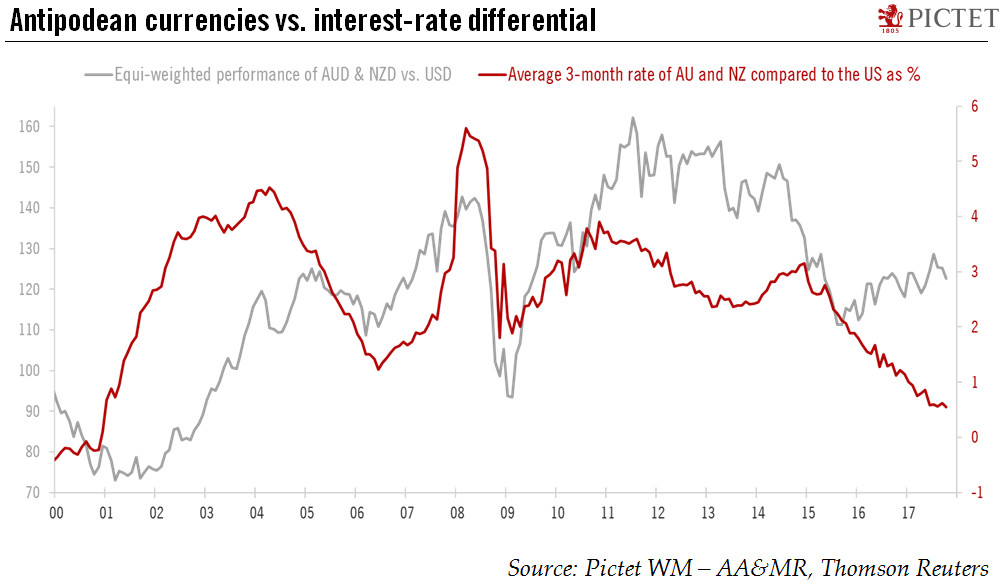

Antipodean currencies tend to be highly influenced by interest-rate differentials (see chart 1) and trends in the commodity market. With the Fed expected to remain in rate-hiking mode at least for the next six months, interest-rate differentials should continue to weigh on the antipodean currencies relative to the US dollar. Valuation is unlikely to be supportive of antipodean currencies either. Although not extremely overvalued, they are among the most expensive major currencies based on CPI purchasing-power parity.

The uncertainty linked to the recent general election led to a sharp decline in the New Zealand dollar (-9.0% relative to the US dollar from 26 July to 26 October) with speculative positions moving into net short territory. But the Australian dollar could be particularly vulnerable in the coming months given uncertainty regarding household consumption and high speculative long positions in the futures market. And while the large down cycle in commodities of 2014-2015 is most likely behind us, the outlook for some key Australian exports remains weak.

We are keeping our 3-month and 6-month forecasts unchanged at USD0.70 for the NZD/USD rate. However, we are lowering slightly our 3-month and 6-month forecasts for the AUD/USD rate to USD0.75 from USD0.76.