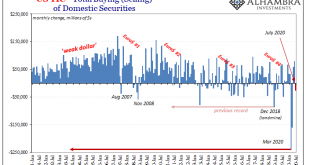

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets. Mostly US Treasuries, especially in official hands, but not entirely those. That much is perfectly clear; you can actually see the difference on every chart despite all the QE’s and trillions in bank reserves...

Read More »Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own. Fill up the bathtub, so to speak, with artificial stimulus water (aggregate demand) until such time as the basin stops...

Read More »Fixed Income: looking for a place to hide

With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US...

Read More »Corporate bonds: February marked by singularly high volatility

Macroview US HY corporate bonds have benefited from the rise in the oil price, whereas European HY corporates are still looking for reassurance from the banking sector. Spreads on corporate bonds widened quite noticeably in February: those on US high-yield issues hit highs not seen since 2011 before narrowing again as China-related fears, worries over the oil price and concern about banks' profitability diminished. The energy and mining sectors were both boosted by the rise in the oil...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org