Euro area bank credit flows were pretty strong in July, despite concerns about the impact of the 23 June Brexit referendum and banks’ health. In July, bank credit to euro area non-financial corporations (NFCs) accelerated, to EUR 12bn (adjusted for sales and securitisations) compared with a rise of EUR 8bn in June and EUR 10bn in May. Lending to NFCs seems to be stable, and on a gentle upward trend. On a country-by-country basis, core countries led the increase on loans to NFCs adjusted for sales and securitisations. In particular, France saw a decent pace of increase in July (+EUR 5.9bn), followed by Germany (+EUR 1.8bn). The increase in Spain was more moderate (+EUR 0.6bn), while Italy saw a decline (-EUR 2.6bn). Credit to households increased as well (+EUR 9bn), although at a slower pace than in the previous month (+EUR 16bn).Meanwhile, the annual rate of expansion of broad money supply (M3) decreased to 4.8% y-o-y in July, from 5.0% in June. Annual growth of the narrow aggregate M1, which includes currency in circulation and overnight deposits, decreased as well, from 8.7% y-o-y in June to 8.4% in July. The annual growth rate of bank loans to the private sector (adjusted for sales and securitisations) increased to 1.7% y-o-y in July, from 1.5% in June. Broken down by sector (see Chart 2), growth in loans to households remained unchanged at 1.

Topics:

Nadia Gharbi considers the following as important: bank credit, euro area, M3, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

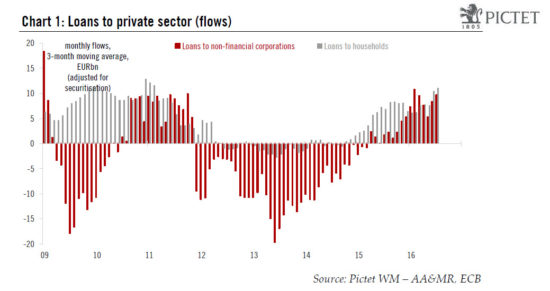

Euro area bank credit flows were pretty strong in July, despite concerns about the impact of the 23 June Brexit referendum and banks’ health.

In July, bank credit to euro area non-financial corporations (NFCs) accelerated, to EUR 12bn (adjusted for sales and securitisations) compared with a rise of EUR 8bn in June and EUR 10bn in May. Lending to NFCs seems to be stable, and on a gentle upward trend. On a country-by-country basis, core countries led the increase on loans to NFCs adjusted for sales and securitisations. In particular, France saw a decent pace of increase in July (+EUR 5.9bn), followed by Germany (+EUR 1.8bn). The increase in Spain was more moderate (+EUR 0.6bn), while Italy saw a decline (-EUR 2.6bn). Credit to households increased as well (+EUR 9bn), although at a slower pace than in the previous month (+EUR 16bn).

Meanwhile, the annual rate of expansion of broad money supply (M3) decreased to 4.8% y-o-y in July, from 5.0% in June. Annual growth of the narrow aggregate M1, which includes currency in circulation and overnight deposits, decreased as well, from 8.7% y-o-y in June to 8.4% in July. The annual growth rate of bank loans to the private sector (adjusted for sales and securitisations) increased to 1.7% y-o-y in July, from 1.5% in June. Broken down by sector (see Chart 2), growth in loans to households remained unchanged at 1.8% in July, while growth in loans to NFCs went up to 1.9% y-o-y, the fastest pace since March 2012.

Overall, putting euro area bank credit flow numbers into our credit impulse calculation, the result is consistent with still-supportive domestic demand growth in Q3, although at a slower pace.

For the months ahead, forward-looking indicators such as July’s Bank Lending Survey (BLS), remain consistent with ongoing credit growth. Nevertheless, we remain cautious. July bank credit flows are the first set of data covering the period since the 23 June Brexit referendum and more data are needed to gauge the impact of Brexit on credit trends. Moreover, banks’ stocks have been under stress recently which could have an impact on their balance sheets with a few months' delay. As a result, at this stage, we see no reason to change our 2016 GDP growth forecast (1.5%) for the euro zone.