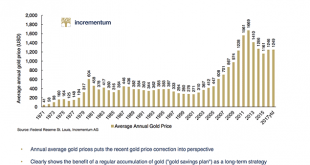

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »Euro bank credit still strong in spite of February weakness

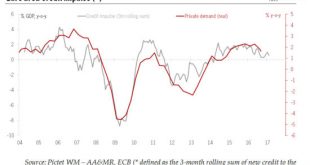

But today's credit report means ECB will have to tread carefully when it comes to reducing the degree of monetary accommodation.The euro area M3 and credit report for February was slightly disappointing overall. Broad money growth (M3) eased from 4.8% to 4.7% y-o-y. Bank loans to non-financial corporations fell back to 2.0% y-o-y in February, from 2.3% in January, as a result of weaker lending flows across the region.Notwithstanding this modest setback, the euro area credit cycle remains...

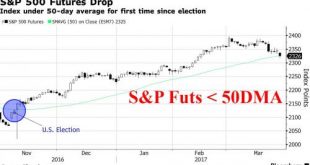

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »Euro area credit flows prove resilient

Euro area bank credit flows were pretty strong in July, despite concerns about the impact of the 23 June Brexit referendum and banks’ health. In July, bank credit to euro area non-financial corporations (NFCs) accelerated, to EUR 12bn (adjusted for sales and securitisations) compared with a rise of EUR 8bn in June and EUR 10bn in May. Lending to NFCs seems to be stable, and on a gentle upward trend. On a country-by-country basis, core countries led the increase on loans to NFCs adjusted for...

Read More »SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full. More than 50 unknown defendants and about 20 known FX banks are named in the case, submitted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org