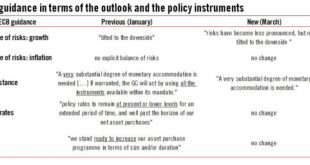

First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer...

Read More »ECB: still broadly confident, but caution increasing

First rate hike still expected in September 2019, although downside risks are growing.The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.Given the tone of today’s meeting, we see no reason to contradict...

Read More »ECB fine tunes communication as recovery broadens

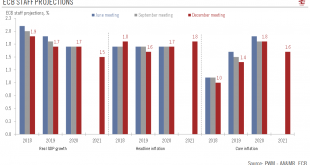

A generally more optimistic ECB looks set to announce its roadmap for QE tapering in September. QE tapering itself may start in Q1 2018.The ECB delivered a fairly balanced, albeit more optimistic message at today’s press conference, echoing upward revisions to the staff projections for 2017-18 euro area GDP growth and inflation. Crucially, however, the 2019 projection for inflation was left unchanged at 1.7%.Looking ahead, the ECB’s four inflation criteria are unlikely to be fully met before...

Read More »Modelling suggests Brexit will cost euro area 0.5% of growth over three years

Macroview In-house simulations of growth impact match those of the ECB PWM has on-boarded the models used in the major central banks to tell us the cost of Brexit for the euro area economy. Using the same models used in major central banks gives our asset allocation policy important advantages. We have the same diagnosis of the situation as the monetary authorities and we are able to enter their mind-set. In the case of Brexit, the challenge has been how to simulate what is essentially a...

Read More »ECB on autopilot, sticks with very dovish message

Macroview There were few surprises at the ECB's Vienna meeting, apart from the modesty of staff projections for inflation. Greek banks' funding was left on hold. Read full report here The ECB left all its policy settings and its forward guidance unchanged at its 2 June Governing Council (GC) meeting in Vienna, implying low interest rates for an extended period of time. The bank’s focus remains on the implementation of new policy measures, with corporate bond purchases starting on 8 June...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org