A generally more cautious Fed emerged from its 14-15 June meeting. We continue to expect just one Fed rate hike in 2016, probably in September Read full report hereFollowing a very weak job report for May, and just one week before the EU referendum in the UK, it should be no surprise that the Fed is in no rush to tighten monetary policy, or to send a strong signal about the timing of the next rate hike. Indeed the Federal Open Market Committee (FOMC) statement struck a more cautious tone, signalling greater uncertainty over both the short- and medium-term rate path.While the FOMC’s economic projections for 2016-2018 were broadly in line with expectations, the main dovish surprise came from the downward revisions to the long-run projection of the equilibrium Fed Fund rate (from 3.25% to 3.00%) as well as the shallower policy rate path to get there. In particular, the updated Fed’s ‘dot chart’ showed six FOMC participants expecting only one more rate hike in 2016 (up from only one in March), although the median was left unchanged at two hikes. For 2017, the median projection was lowered from four to three hikes. Fed chairwoman Janet Yellen mentioned the renewed decline in the equilibrium rate as one factor behind the lower dot plot.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Fed dot chart, Fed rate hikes, FOMC meeting, Macroview, US economic projections

This could be interesting, too:

Stephen Flood writes Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

A generally more cautious Fed emerged from its 14-15 June meeting. We continue to expect just one Fed rate hike in 2016, probably in September

Following a very weak job report for May, and just one week before the EU referendum in the UK, it should be no surprise that the Fed is in no rush to tighten monetary policy, or to send a strong signal about the timing of the next rate hike. Indeed the Federal Open Market Committee (FOMC) statement struck a more cautious tone, signalling greater uncertainty over both the short- and medium-term rate path.

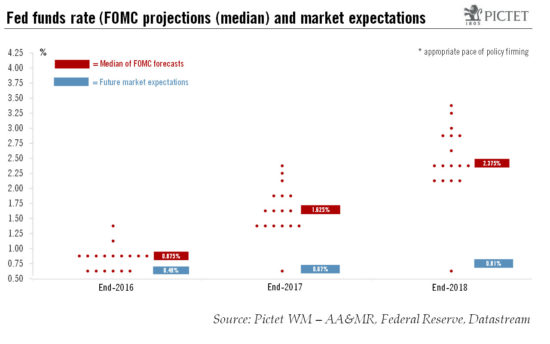

While the FOMC’s economic projections for 2016-2018 were broadly in line with expectations, the main dovish surprise came from the downward revisions to the long-run projection of the equilibrium Fed Fund rate (from 3.25% to 3.00%) as well as the shallower policy rate path to get there. In particular, the updated Fed’s ‘dot chart’ showed six FOMC participants expecting only one more rate hike in 2016 (up from only one in March), although the median was left unchanged at two hikes. For 2017, the median projection was lowered from four to three hikes. Fed chairwoman Janet Yellen mentioned the renewed decline in the equilibrium rate as one factor behind the lower dot plot. This alone suggests that the balance of risks is skewed towards an even more gradual pace of monetary tightening in the next couple of years, or at the minimum a greater tolerance from the Fed for any rebound in wage growth and inflation.

A July rate hike – which Chair Yellen described as “not impossible” – is now looking increasingly unlikely in light of the much shallower policy rate path projected by the FOMC at the June meeting. One would need a combination of favourable outcomes – including a strong improvement in labour market conditions in the US, an increase in global risk sentiment, no Brexit and political stability in the euro area – and even then, the decision would likely be a very close call.

Overall, downside risks continue to dominate our baseline scenario, notably those associated with global economic and potential financial developments. We continue to believe that the FOMC will hike rates only once in 2016, most probably in September. Looking ahead, the balance of risks is tilted towards a more gradual pace of policy normalisation relative to our baseline of three additional 25bp hikes in 2017.