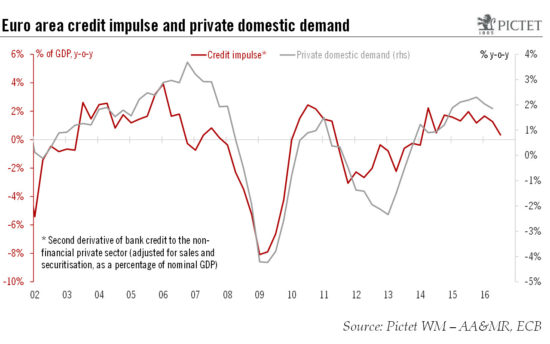

Macroview Credit flows to households and corporations slackened in August, so domestic demand may be less of a factor in near-term growth. But we are sticking to our full-year growth forecast for the euro area. Credit to euro area households increased in August. Although at a slower pace than the previous month, August was the 23th straight month of positive credit flows. By contrast, bank credit to euro area non-financial corporations (NFCs) declined by EUR1 bn in August (adjusted for sales and securitisations) after four months of solid expansion. On a country-by-country basis, there were particularly sharp declines in Italy and Spain. Bank credits to NFCs contracted in France as well—but only after 11 months of solid loan expansion—while they increased in Germany. The annual growth rate of bank loans to the private sector (adjusted for sales and securitisations) stood at 1.7% y-o-y in August, unchanged from the previous month.Overall, after having put euro area bank credit flow numbers through our credit impulse calculation, the latest data are consistent with domestic demand being less supportive of growth in Q3 (data to be published on October 31). Nevertheless, forward-looking indicators such as July’s Bank Lending Survey (BLS) remain consistent with ongoing in the months ahead and we are leaving unchanged our euro area GDP growth forecast for 2016 at 1.5%.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Credit demand, euro area credit, Euro bank lending, Macroview, TLTRO II

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Credit flows to households and corporations slackened in August, so domestic demand may be less of a factor in near-term growth. But we are sticking to our full-year growth forecast for the euro area.

Credit to euro area households increased in August. Although at a slower pace than the previous month, August was the 23th straight month of positive credit flows. By contrast, bank credit to euro area non-financial corporations (NFCs) declined by EUR1 bn in August (adjusted for sales and securitisations) after four months of solid expansion. On a country-by-country basis, there were particularly sharp declines in Italy and Spain. Bank credits to NFCs contracted in France as well—but only after 11 months of solid loan expansion—while they increased in Germany. The annual growth rate of bank loans to the private sector (adjusted for sales and securitisations) stood at 1.7% y-o-y in August, unchanged from the previous month.

Overall, after having put euro area bank credit flow numbers through our credit impulse calculation, the latest data are consistent with domestic demand being less supportive of growth in Q3 (data to be published on October 31). Nevertheless, forward-looking indicators such as July’s Bank Lending Survey (BLS) remain consistent with ongoing in the months ahead and we are leaving unchanged our euro area GDP growth forecast for 2016 at 1.5%. But we remain cautious. August bank credit flows are only the second set of data covering the period since the 23 June Brexit referendum and more data are needed to have a real gauge of the impact of Brexit on credit trends.

We still expect ECB’s TLTRO-II to provide a marginal boost to the credit cycle after last week’s auction generated larger-than-expected demand of EUR45 bn from euro area banks. There is no official breakdown across countries, but we estimate that banks in Italy and in Spain hold around 60% of all TLTRO loans outstanding, with a potential lending subsidy from this scheme of over EUR1 bn for banks in both countries. As well as being supportive of the credit cycle, we believe the TLTRO-II subsidy helps mitigate the cost of negative deposit rates on the euro area banking sector in aggregate.