With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our...

Read More »Gradual, moderate rise in the 10-year US Treasury yield next year

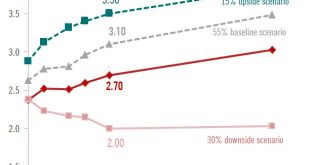

Modest inversion in yield curve, with recession more of an issue for 2020.After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet...

Read More »FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

Swiss Franc Currency Index In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency...

Read More »FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Swiss Franc Currency Index The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers as so-called “safe haven” buying was reversed during the week after Brexit. But the Swiss Franc index is still stronger in the last month. Via Financial Times. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance. On a three years interval, the Swiss...

Read More »FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

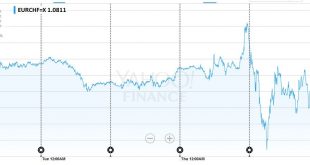

EUR/CHF The Euro-Swiss remained nearly stable at the begin of the week. It peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. We showed the obvious SNB intervention that started at 7.45 am. on Friday. FX Rates June 20 to June 24, 2016 click to enlarge, Source Yahoo Finance USD/CHF After being nearly stable during the week, the dollar...

Read More »U.S. Treasuries tugged between fear and hope

Macroview Several factors have led us to revise downward our target 10-year U.S. Treasury rate for end 2016. Read full report hereAs we arrive close to the end of the first half of 2016, it is time to revisit our 2016 scenario for US Treasuries. Since we formulated our scenario in October 2015, giving a target 10-year US Treasury yield of 2.7% for the end of 2016, many things have changed. First, the beginning of the year saw considerable turmoil in financial markets, with negative...

Read More »Saudi-Arabia: Peg or Banking Crisis?

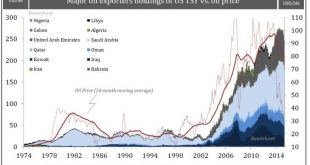

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org