The report (in German). From the press release: The Parliamentary Investigation Committee (PInC) attributes the Credit Suisse crisis to years of mismanagement at the bank. It is critical of FINMA’s relaxation of capital requirements and regrets the lack of effectiveness of its banking supervision. The PInC also criticises the hesitant development of the TBTF legislation and identifies shortcomings in the flow of information between authorities. It does not find any misconduct on the part...

Read More »A Financial System Built on Bail-Outs?

In a Wall Street Journal opinion piece and an accompanying paper and blog post, John Cochrane and Amit Seru argue that vested interests prevent change towards a simpler, better-working financial system. They describe various “bail-outs” since 2020, in the U.S. financial sector and elsewhere. They point out that in Switzerland, too, the government orchestrated takeover of Credit Suisse by UBS relied on taxpayer support. And they conclude that regulatory measures after the great financial...

Read More »“Retail CBDC and the Social Costs of Liquidity Provision,” VoxEU, 2023

VoxEU, September 27, 2023. HTML. From the conclusions: … it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures. … the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly. … the interest rate on CBDC should differ from zero and from the rate on reserves. From...

Read More »Report of the Banking Stability Expert Group

The “Banking Stability” Expert Group that was formed following the failure of Credit Suisse has published its report (in German). I quote and add my own comments in brackets […]. Summary: Die staatlich unterstützte Übernahme der Credit Suisse durch die UBS im März 2023 hat eine gefährliche Situation schnell stabilisiert. Die Schweiz hat damit einen wichtigen Beitrag zur internationalen Finanzstabilität geleistet. Die Credit Suisse war am 19. März 2023 die erste global systemrelevante Bank...

Read More »Will Basel III Send Gold to the Moon, Report 2 Apr

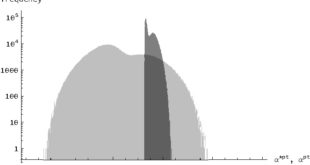

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm). Will it? It would be easy to say—as with all of their other predictions of gold to infinity and beyond—“wait and see.” But...

Read More »“Regulierung und Wettbewerb (Regulation and Competition),” FuW, 2017

Finanz und Wirtschaft, December 13, 2017. PDF. Ökonomenstimme, December 15, 2017. HTML. Regulation is about aligning private and social trade-offs. When banks cause negative externalities, good regulatory interventions increase banks’ costs. Externalities may differ across countries, so nothing suggests that regulation induced costs should be the same internationally.

Read More »Fintech Regulation in Switzerland: Open Questions

In the NZZ, Jürg Müller reports about the developing regulatory framework for fintechs in Switzerland. A proposal by the federal finance department drew—reasonable—criticism by various lobbies and industry associations, including the CFA Society Switzerland. Die CFA Society Switzerland will das systemrelevante Bankensystem von anderen Finanzdienstleistern trennen. Dafür sei eine präzisere Bankendefinition nötig, als sie heute vorgenommen werde. Nur Banken sollen demnach dem Bankengesetz...

Read More »Have Banks Become Less Risky?

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been...

Read More »McMillan’s “The End of Banking”

Jonathan McMillan proposes a systemic solvency rule which stipulates that [t]he value of the real assets of a company has to be greater than or equal to the value of the company’s liabilities in the worst financial state. (p. 147) That is, the financial assets of a company have to be financed by equity. This reminds of Kotlikoff’s limited purpose banking, see here and here. McMillan (who is actually two persons, a banker and a journalist) argues that Kotlikoff’s proposal is a step in the...

Read More »“Dirk Niepelt über die Folgen eines Brexit für die Schweiz (What Brexit Means for Switzerland),” SRF, 2016

SRF, Tagesgespräch, June 16, 2016. HTML with link to MP3. Half-hour-long interview on the Swiss news channel. Topics include monetary policy, exchange rates, financial stability, Brexit.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org