The ‘Fed put’ – gone until there’s blood in the streets Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies. And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting. The Fed’s stance pivot from ‘the economy needs additional stimulus’ to ‘it is time to start...

Read More »Green Returns

In the NBER working paper “Dissecting Green Returns,” Lubos Pastor, Robert Stambaugh, and Lucian Taylor argue that excess returns on green assets during recent years are unlikely to predict expected excess returns. At least that’s what theory suggests: … green assets have lower expected returns than brown, due to investors’ tastes for green assets, yet green assets can have higher realized returns while agents’ tastes shift unexpectedly in the green direction. … green tastes can...

Read More »Portfolio Adjustments in Money Market Mutual Funds

On the Liberty Street Economics blog, Catherine Chen, Marco Cipriani, Gabriele La Spada, Philip Mulder, and Neha Shah discuss last year’s regulatory changes regarding money market mutual funds: First, institutional prime and muni funds—but not retail or government funds—must now compute their net asset values (NAVs) using market-based factors, thereby abandoning the fixed NAV that had been a hallmark of the MMF industry. Second, all prime and muni funds must adopt a system of gates and...

Read More »On the Performance of Swiss Portfolio Managers

In the NZZ, Michael Schaefer reports on a study about the performance of Swiss portfolio managers in 2016. The median portfolio returns in all investment strategies except those not investing in stocks fell short of the corresponding benchmark returns. Only a fifth of the portfolios generated returns in excess of their benchmark. These numbers do not yet account for management fees. No portfolio manager generated high returns across all strategies. But some managers consistently generate...

Read More »New Questions about Greece’s Indebtedness

On the FT’s Alphaville blog, Matthew Klein reports about discrepancies between IMF and Greek (and EU) assessments of Greek net indebtedness. The IMF appears to report lower Greek financial asset holdings than the Greek Central Bank. Matthew Klein quotes the Greek Central Bank: We would like to clarify that the Bank of Greece compiles its financial accounts, from which data on the general government’s net debt are derived, according to European standards. The Bank of Greece’s data are...

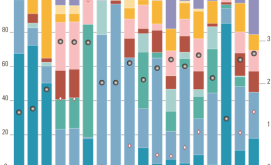

Read More »The Public Sector’s Portfolio Choice

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org