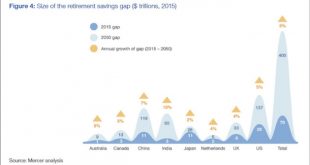

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Basic Income Arrives: Finland To Hand Out Guaranteed Income Of €560 To Lucky Citizens

Just over a year ago, we reported that in what was set to be a pilot experiment in “universal basic income”, Finland would become the first nation to hand out “helicopter money” in the form of cash directly to a select group of citizens. As of January 1, 2017, the experiment in “basic income” has officially begun, with Finland becoming the first country in Europe to pay its unemployed citizens the guaranteed monthly sum...

Read More »The Public Sector’s Portfolio Choice

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.

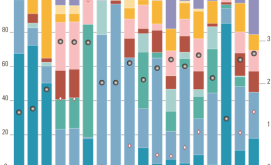

Read More »Tax Wedges

The average tax wedge in OECD countries has been stable over the last 15 years, at roughly 36 percent. OECD data. From The Economist, a decomposition in the cross section:

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org