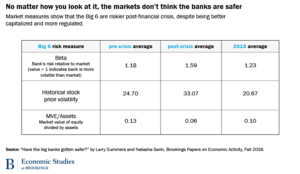

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been offset by a dramatic decline in the franchise value of major financial institutions, caused at least in part by these new regulations. This table is taken from their paper: However, their finding need not be as bad as it sounds. After all, bank regulators intended to insulate taxpayers against bank failure and to render the financial system more shock proof, not bank equity.

Topics:

Dirk Niepelt considers the following as important: Bank, Bank regulation, Contributions, equity, Financial market, Financial stability, Notes, Taxpayer

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not:

… we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. …

… financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been offset by a dramatic decline in the franchise value of major financial institutions, caused at least in part by these new regulations.

This table is taken from their paper:

However, their finding need not be as bad as it sounds. After all, bank regulators intended to insulate taxpayers against bank failure and to render the financial system more shock proof, not bank equity.