Our guest this week is Ed Steer, expert gold and market analyst and author of the Gold & Silver Digest. We invited Ed onto GoldCore TV to get his take on what is concerning him most in financial markets, movements in SLV and sanctions against Russia. He also draws our attention to central bank purchases of gold. Ed’s interview serves as a reminder that those who currently do own gold and silver are just the tip of the iceberg when it comes to the number of people...

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

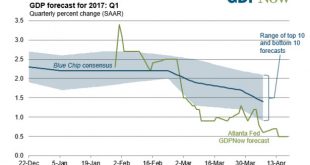

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble...

Read More »Risk Reward Analysis for Financial Markets

By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary...

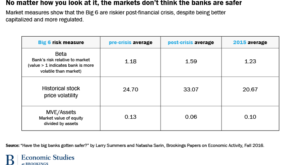

Read More »Have Banks Become Less Risky?

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org