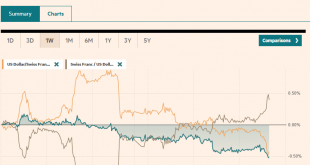

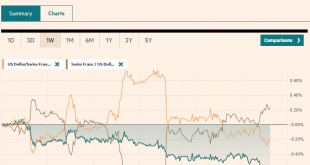

Swiss Franc The Euro has fallen by 0.08% to 1.0904 EUR/CHF and USD/CHF, June 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Falling US yields weigh on the US dollar. The 10-year Treasury yield is flirting with the 1.50% mark, and the greenback is trading heavily against all the major and most emerging market currencies. European and the Asia Pacific benchmark yields are lower as well. The JP Morgan...

Read More »All you need to know about the Trinity Study

You have probably heard of the 4% rule if you are interested in early retirement. This rule states that if you withdraw 4% of your portfolio every year, you can sustain your withdrawals for 30 years. But do you know where it comes from? If you have read a lot about it, you probably heard about the Trinity Study. This study is where it all started. But do you know what the Trinity Study is? Probably not. A lot of things people are saying about the Trinity Study are...

Read More »Switzerland clears Covid-19 vaccine for 12 to 15 year-olds

On 4 June 2021, Swissmedic, Switzerland’s drug approval authority, announced it was extending authorisation of the Pfizer/BioNTech vaccine to 12-15 year olds. © Irina Zharkova | Dreamstime.com The vaccine, also known under the brand name Comirnaty®, has had temporary ordinary authorisation for use in Switzerland on people aged 16 or over since 19 December 2020. Swissmedic started looking at approving the vaccine for use on younger people on 7 May 2021 and reviewed...

Read More »The Sources of Rip-Your-Face-Off Inflation Few Dare Discuss

We’re getting a real-world economics lesson in rip-your-face-off increases in prices, and the tuition is about to go up–way up. Inflation will be transitory, blah-blah-blah–I beg to differ, for these reasons. There are numerous structural sources of inflation, which I define as prices rise while the quality and quantity of goods and services remain the same or diminish. Since the word inflation is so loaded, let’s use the more neutral (and more accurate) term...

Read More »FX Daily, June 08: Marking Time ahead of the Week’s Big Events

Swiss Franc The Euro has fallen by 0.20% to 1.0916 EUR/CHF and USD/CHF, June 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets appear to be in a holding pattern ahead of this week’s big events, including the US CPI and the ECB meeting. Equities are little changed but with a heavier bias evident. Most of the large bourses in the Asia Pacific region were lower, except Australia, which eked...

Read More »The role of the Swiss National Bank (SNB)

(Disclosure: Some of the links below may be affiliate links) What the Swiss National Bank (SNB) does is not very clear for many people in Switzerland. So, I thought it would be interesting to research this subject and write about my findings. The Swiss National Bank is quite famous, even abroad, but what does it really do? It is because of it that we do not have any interest rate in our bank accounts? Let’s see in detail what this central bank is doing. We will also...

Read More »How robot cars may transport freight under Switzerland

Cargo sous terrain, or underground cargo, is a futuristic Swiss freight project aimed at relieving pressure off existing roads and other infrastructure. The plan is to build a 500-kilometre network of tunnels linking production sites and logistics hubs in Switzerland’s biggest cities. Electric driverless vehicles will transport goods from hub to hub below ground. The private venture, which is planned for completion in 2045, is expected to cost CHF30-35 billion ($33-38 billion). But...

Read More »Swiss pesticide votes – pesticides, antibiotics, gut bacteria, hormones and disease

As we move through time scientific research improves our understanding of the world. The resulting revelations often point to changes that could lead to progress. However, these changes are rarely painless. © Prot Tachapanit | Dreamstime.com Shifting away from the use of antibiotics on livestock and the agricultural use of pesticides are not small adjustments. They underpin current farming methods on many Swiss farms. And using these substances has clear short term...

Read More »9 Top-Ranked Crypto Blockchain Project Coins You’ve Probably Never Heard of Before

Cryptocurrencies have been all the rage this year with total market capitalization surging 132% since the beginning of the year. Given this crypto frenzy, it is quite remarkable how some of the top marketcap ranking firms have eluded mainstream attention. Fintech News compiled a list of top nine cryptocurrency firms ranked (#) by market cap according to coinmarketcap. These crypto firms haven’t been featured much by the mainstream media so far, probably with the...

Read More »Price Discovery is Alive and Well in Crypto

“If the market continues to see wild swings based on Elon Musk tweets, it’s going to be a big setback for this asset class,” Matt Maley, chief market strategist for Miller Tabak + Co. told Bloomberg. “The fact that it sees such wild swings to the tweets from one person takes away the legitimacy of the asset class.” Reminds a bit of a financial planner who told me bitcoin is “manipulated” and followed up with the ultimate smear “unregulated.” Yikes. Then the Chinese...

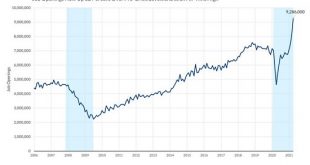

Read More » SNB & CHF

SNB & CHF