[embedded content] Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power. They focus on improving public policy at the state level via the Sound Money Defense League. There are more options for improving laws at a state level than at the Federal level, and they have had several successes. To that end, they have created a Sound Money Index that measures differences between states regarding policies like sales taxes. He outlines why sales taxes on investments like bullion is a silly idea. He discusses how inflation affects

Topics:

Stefan Gleason considers the following as important: 6a.) Gold Standard, 6a) Gold & Monetary Metals, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power.

They focus on improving public policy at the state level via the Sound Money Defense League. There are more options for improving laws at a state level than at the Federal level, and they have had several successes. To that end, they have created a Sound Money Index that measures differences between states regarding policies like sales taxes. He outlines why sales taxes on investments like bullion is a silly idea.

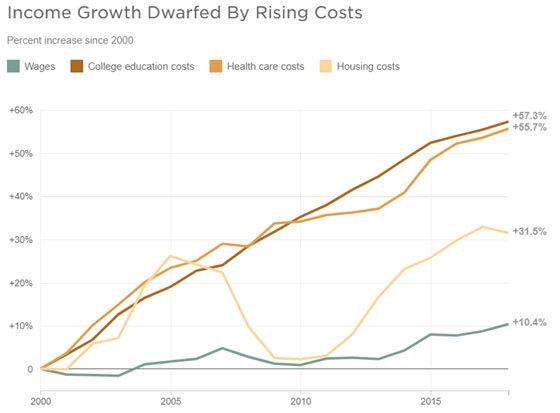

He discusses how inflation affects capital assets that are often taxed, but there is no actual gain in wealth in most cases. Taxes are one of the great injustices of our system because it slowly destroys wealth. The IRS considers bullion to be collectibles and is taxed higher than other investments, and States typically follow after the Federal policies. They have been able to remove gold and silver from the State income tax in Arizona and Wyoming. They point out to legislatures that taxing metals drives business to other states.

He explains the potential merits of the Texas Depository Systems and why it was setup outside of Wall Street interests.

States and smaller governments often have reporting and holding requirements for small dealers and pawnshops. They are required to upload photos of items along with the information about the seller. This system is very inefficient and a significant burden on the dealers.

He discusses the Federal Reserve System and why pushing for sound money at that level is difficult. They are pressing for audits of America’s gold holdings since these have not been audited in over seventy years. There are concerns regarding the quantity and quality of the metal, and just because the gold is in a vault doesn’t mean the United States has ownership.

Lastly, Stefan gives an overview of Money Metals, their various services, and educational resources.

Time Stamp References:

0:00 – Intro

1:52 – Defining Sound Money

4:10 – Sound Money Index

8:06 – State Taxes on Metals

14:14 – Capital Gains & Inflation

21:27 – Buying across State Lines

26:44 – Texas Depository System

31:14 – Four Areas of Bad Laws

36:26 – Sound Money Scores

40:19 – Federal Progress

46:54 – Monthly Savings Plan

49:35 – Money Metals & Wrap Up

Talking Points From This Episode

- Promoting Sound Money at the state level.

- Purpose of the Sound Money Index

- Inflation & Capital Gains Taxes

- Promoting Sound Money at the Federal Level.

Guest Links:

Twitter: https://twitter.com/MoneyMetals

Website: https://moneymetals.com

Website: https://www.soundmoneydefense.org/

Stefan Gleason is President of Money Metals Exchange, a national precious metals investment company and news service with over 500,000 readers and 250,000 customers. He launched the company while president of a national newsletter publishing company dedicated to helping subscribers protect their freedoms, assets, and privacy.

Gleason founded Money Metals Exchange in 2010 in response to the abusive practices of national advertisers of “rare” coins. These companies often mark up their coins to 50%, 100%, or even higher above their actual melt value. Money Metals believes the average investor should only purchase precious metals at or near their true melt value. The rare coin market is only suitable for highly experienced collectors with money to blow.

Gleason also leads marketing, publishing, and real estate holding companies and legislative projects involving sound money and the precious metals industry. Previously, Gleason served as Vice President of the National Right to Work Legal Defense Foundation in Springfield, Virginia. Gleason is a graduate of the University of Florida with a BA degree in Political Science.

Gleason has frequently appeared on national television shows and networks such as CNN, CNBC, Fox News, Christian Broadcasting Network, and C-SPAN’s Washington Journal. He is often interviewed on national radio shows such as the Lars Larson Show, Michael Reagan Show, G. Gordon Liddy Show, and Ken Hamblin Show. Gleason’s analysis and commentary have appeared in The Wall Street Journal, TheStreet.com, Seeking Alpha, Investing.com, Newsweek, and National Review, among thousands of other national, state, and local newspapers, wire services, and Internet sites.

Tags: Featured,newsletter