Visa revealed that its customers had spent more than US$1 billion on its crypto-linked cards in the first half of 2021. The payments giant reported that it had partnered with 50 leading crypto platforms on card programmes that make it easy to convert and spend digital currency at 70 million merchants worldwide. Visa had previously announced in March 2020 that it will allow the use of USD Coin (USDC), a stablecoin backed by the US dollar, to settle transactions on...

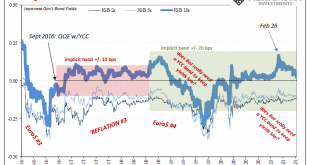

Read More »Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change. Inflation had finally been achieved across multiple geographies, it was widely repeated, and this would create problems, purportedly, as these various places would have to grapple with higher interest rates. The idea behind...

Read More »Swiss Unemployment back below 3% again

On 8 July 2021, the Secretariat for Economic Affairs (SECO) published unemployment figures for June 2021. © Fizkes | Dreamstime.com By the end of June 2021, there were close to 132,000 people registered as unemployed across Switzerland, 11,000 fewer than at the end of May 2021, bringing Switzerland’s overall unemployment rate down from 3.1% to 2.8%. Youth employment dropped particularly sharply compared to a year earlier. Unemployment among this age group (15-24) was...

Read More »Swiss Narrowly Miss CO2 Emission Targets

CO2 emissions from heating oil and gas only dropped slightly last year despite mild winter temperatures. © Keystone/Gaetan Bally Switzerland has again failed to meet its goals for reducing greenhouse gas emissions, prompting a rise in CO2 taxes. Last year emissions from fuel, including heating oil and gas, were 31% lower than 1990 levels, according to data released by the Federal OfficeExternal link for the Environment on Wednesday. This is unchanged from 2019 and...

Read More »FX Daily, July 08: Capital Markets Remain Unhinged

Swiss Franc The Euro has fallen by 0.51% to 1.0852 EUR/CHF and USD/CHF, July 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today. Signals that the...

Read More »The Pandemic has Widened the Wealth gap. Should Central Banks be Blamed?

THE GLOBAL financial crisis of 2007-09 was socially divisive as well as economically destructive. It inspired a resentful backlash, exemplified by America’s Tea Party. That crisis at least had the tact to spread financial pain across the rich as well as the poor, however. The share of global wealth held by the top “one percent” actually fell in 2008. The pandemic has been different. Amid all the misery and mortality, the number of millionaires rose last year by 5.2m...

Read More »Keynes Said Inflation Fixed the Problems of Sticky Wages. He Was Wrong.

Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay. If buyers and sellers simply disagree, then so be it. But if the situation is aggravated by excessive regulation or other institutional problems, then economists would advise dissolving institutional barriers that prevent...

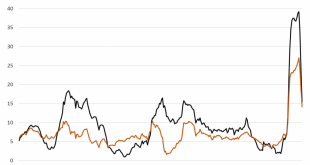

Read More »Money Supply Growth Dropped in May to a 15-Month Low

Money supply growth slowed again in May, falling for the third month in a row, and to a 15-month low. That is, money supply growth in the US has come down from its unprecedented levels, and if the current trend continues will be returning to more “normal” levels. Yet, even with this slowdown, money-supply growth remains near some of the highest levels recorded in past cycles. During May 2021, year-over-year (YOY) growth in the money supply was at 15.3 percent....

Read More »Covid: Swiss Health Minister Concerned by Rest Home Staff Vaccine Refusal

In Switzerland, 20% of people over 80 have not been vaccinated against Covid-19 at a time when the fast spreading Delta variant is gaining ground, said Alain Berset, Switzerland’s health minister, in an interview with the NZZ reported RTS. © Arne9001 | Dreamstime.com Berset said he’s concerned that too many people do not want to get vaccinated. But in rest homes we have a worse problem, he said. A considerable portion of staff working in rest homes or offering home...

Read More »FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

Swiss Franc The Euro has fallen by 0.03% to 1.0922 EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible...

Read More » SNB & CHF

SNB & CHF