Stock Markets EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month. Stock Markets Emerging Markets,...

Read More »Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers International Women’s Day highlights the underreported UK Women’s pension crisis 2.66 million affected by UK government’s change to state pension act Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees Changes by government highlights the counterparty risks pensions are exposed to Global problem as pensions gap of...

Read More »Meat sales drop in Switzerland

Swiss butchers and supermarkets are selling less pork (Keystone) - Click to enlarge Less meat was sold in Switzerland in 2017 than the previous year, although the average Swiss still consumed a good 26 kilograms of meat over the year. Sales of domestic and imported meat fell by 0.7% to 221,468 tonnes, the Federal Office for Agricultureexternal link reported. Turnover also dropped by 0.7% to CHF4.64 billion...

Read More »Tax ‘total meltdown’ averted

The price and the VAT on a receipt in Zurich (Keystone) - Click to enlarge More than 84% of voters have renewed the government’s right to tax its citizens and companies for another 15 years. This is a unique feature of Switzerland’s political system of direct democracy and federalism. External Content Live results of March 04 2018 ballot: Licence fee for public broadcasters and Federal taxes 2021 Live...

Read More »China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

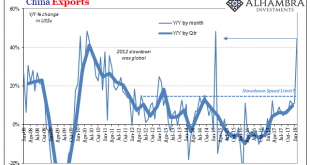

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative. A strengthening U.S. recovery is helping underpin China’s outlook as Asia’s biggest economy seeks to cut excess capacity and transition to reliance on...

Read More »Forget “Free Trade”–It’s All About Capital Flows

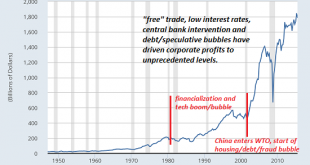

In a world dominated by mobile capital, mobile capital is the comparative advantage. Defenders and critics of “free trade” and globalization tend to present the issue as either/or: it’s inherently good or bad. In the real world, it’s not that simple. The confusion starts with defining free trade (and by extension, globalization). In the classical definition of free trade espoused by 18th century British economist David...

Read More »CHARLES HUGH SMITH – Has The Date Been Set For The Great Economic Collapse

Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. SUBSCRIBE FINANCIAL GUIDE for Latest on Financial News,Gold News,Silver News, Stock Market News,Bitcoin News,Political News,Oil News,Economic News,Economic Collapse News ..

Read More »Charles Hugh Smith What’s Your Job Worth work, money and automation

Charles Hugh Smith What's Your Job Worth work, money and automation

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank. SNB FX Intervention In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held...

Read More »UBS publishes Annual Report 2017

Zurich/Basel, 9 March 2018 – The Annual Report 2017 provides comprehensive and detailed information on the firm, its strategy, business, governance, financial performance and risk, treasury and capital management, as well as on the regulatory and operating environment for the financial year 2017. UBS net profit attributable to shareholders for 2017 was CHF 1.1 billion and diluted earnings per share were CHF 0.27. The...

Read More » SNB & CHF

SNB & CHF