US-China Trade War Escalates As Further Measures Are Taken – Trade war between two superpowers continues to escalate– White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’– US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium– China “will certainly take necessary measures to protect our legitimate rights.”– China is USA’s largest trading partner, fastest-growing market for U.S. exports, 3rd largest market for U.S. exports in the world.– If the U.S. continues to escalate its trade actions against China, experts say retaliation is likely.– Global markets are unprepared, investors should invest in gold to protect portfolios -

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| US-China Trade War Escalates As Further Measures Are Taken

– Trade war between two superpowers continues to escalate |

|

| President Trump has long accused China of ‘one of the greatest thefts in the history of the world’ and he campaigned hard on the issue during his run for the White House. So, it is no surprise that his administration are doing something about what they view as an unfair trade set-up.

Last week commerce secretary Wilbur Ross announced the possible ‘global tariff of at least 24% on imports of steel and 7.7% on aluminum after investigations into trade in both metals determined that import surges seen in recent years “threaten to impair [US] national security.”’ Unsurprisingly China have responded, calling the US reckless and confirming that they would take steps in order ‘to protect our legitimate rights.’ There is a lot at stake here both financially and politically. In 2016 the two countries did $578.6bn worth of trade and both are seen as global super-powers competing for hegemony in an increasingly polarised world. Brewing for some timeAt the end of 2017 Trump warned that he would be taking tough measures on China who he sees as an existential economic threat on his country, “We are declaring that America is in the game and America is going to win,”. At that point Trump had done more talking than actually doing anything to impact trade with China. The China Foreign ministry responded: “We urge the United States to stop the strategic intention of deliberately distorting China and abandon the outdated concepts of Cold War thinking and zero-sum game, or else it will only harm itself.” 2018 has been quite different with two separate sets of announcements regarding tariffs and trade with China. The first focused on solar panels, the latest on industrial metals. Both are major exports and sources of income for the Communist country. With this in mind, it is unlikely that the Chinese super-power is going to take these moves lying down or that global financial markets will not be affected. But, in the meantime they will likely bide their time: Trade war or war of words?For now the trade war is unlikely to go too far past a war of words, on China’s side. They have other tools up their sleeves which could impact the US economy but not be seen as a full on defensive against America’s trade policies. For now, all they have done is announce that it is investigating U.S. exports of sorghum and imposing measures on styrene, which is used to make plastic products. These measure are unlikely to go too far, for example Chinese farmers need American soybeans to feed their livestock. But there are other areas China could make things sting a little too. The country is one of the top five buyers of US cars, currently. By 2022 it is expected to contribute to over half of the world’s car market growth. The government could easily instruct Chinese citizens to no longer buy US cars, hurting the latter’s automotive industry. We also see huge spending from China when it comes to tourism. By 2025 Chinese tourists are forecast to spend $450bn on vacations abroad. The US is increasingly benefitting from the 130 million Chinese tourists that venture into the world each year. However the biggest tool they have up their sleeve, away from trade policies is the selling of US debt, of which it owns more than $1tn. As Jim Rickards reminded us, last week:

Global implicationsWhilst the US begins to fight against globalisation and China tries to embrace it, both are forgetting how intertwined it makes the world. A trade war between the two countries will not only impact them but also emerging countries in Asia. Consider the steep 30% U.S. tariffs on imports of solar panels and washing machines, announced at the end of January. Capital Economics issued a stark warning about how this could affect the rest of the world’s emerging markets: |

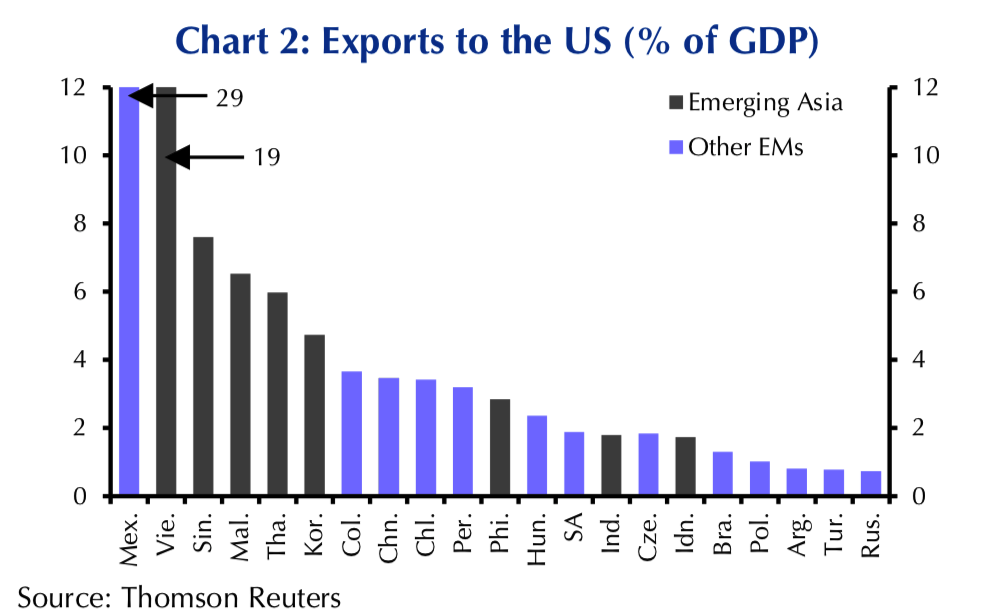

Exports to the US |

Countries in Emerging Asia export more to the US than most other emerging markets (Chart 2), and more generally have been among the biggest beneficiaries of globalisation in the world. Any moves towards protectionism would deal a blow to the region’s most trade-dependent economies such as Singapore, Taiwan and Vietnam. Korea would also be badly hit if instead of trying to renegotiate the Korea- US Free Trade Agreement (KORUS), the US completely withdrew from the deal.

There have been multiple warnings and theories from experts about how a trade war between China and the US will end. Possibly the most insightful is from Edward Wong, the New York Times’s former Beijing bureau chief. In a recent essay, he concludes:

“[China’s] Communist Party embraces hard power and coercion, and this could well be what replaces the fading liberal hegemony of the United States on the global stage. It will not lead to a grand vision of world order. Instead, before us looms a void.”

Be prepared for the unprepared

In truth no-one knows how the trade war between the US and China will escalate. Both countries need one another but they are also both led by men who believe in the singular power of their own countries, across the globe.

As we saw from the markets’ reaction when China leaked they may move away from US Treasuries, the financial order is not quite prepared for a major division between the two countries.

From the two announcements by the Trump administration in the last fortnight, it is possible that the trade war could get ugly very fast. Should this happen the the world economy will be the battle ground on which is it is fought.

Now would be an excellent opportunity for investors to prepare their portfolios for volatility and stock up on gold as a safe haven.

Tags: Daily Market Update,Featured,newsletter