© Hai Huy Ton That | Dreamstime.com Ticket machines once replaced many of the people selling ticket from counters. Now the internet and mobile phones threatens ticket machines. As more and more people use dash past ticket machines with an electronic train ticket in their pocket, Swiss Rail is looking at phasing out some machines according to various newspapers including 20 Minutes. The 150 machines selling fewer than 20...

Read More »Basel-EuroAirport rail link should open in 2028

EuroAiport is located in France, in the tri-national Upper Rhine Region, just a few kilometres northwest of the Swiss city of Basel. The EuroAirport Basel-Mulhouse-Fribourg Airport should be accessible by rail by 2028. Project leaders are convinced that trains will replace the buses currently connecting the city of Basel to the airport within ten years. The French national railway company SNCF said on Thursday that is...

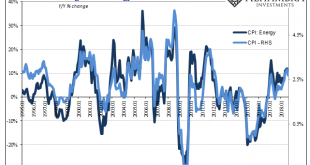

Read More »Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains. Yet, the CPI headline retreated a little further than expected. After reaching the highest since December 2011 the month before,...

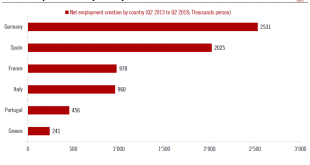

Read More »European labour market remains in rude health

But there is room for further improvement. This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area. One development of note is that employment growth has been broad,...

Read More »Swiss agricultural policy costs households 2,500 francs a year, according to study

© Denis Linine | Dreamstime.com Broadly, Switzerland’s agricultural sector costs the country CHF 19.9 billion while contributing only CHF 3.4 billion, concludes a study published by the think tank Avenir Suisse. The CHF 19.9 billion cost the report’s authors calculate is made up of tax breaks and direct federal and cantonal payments to the sector (4.9b), the cost of artificially inflated consumer prices due to import...

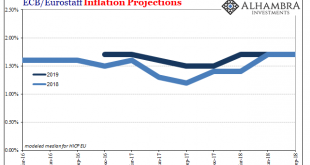

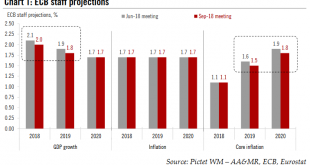

Read More »ECB (Data) Independence

Mario Draghi doesn’t have a whole lot going for him, but he is at least consistent – at times (yes, inconsistent consistency). Bloomberg helpfully reported yesterday how the ECB’s staff committee that produces the econometric projections has recommended the central bank’s Governing Council change the official outlook. Since last year, risks have been “balanced” in their collective opinion. Given what’s happened this...

Read More »FX Daily, September 14: Dollar Losses Extended

Swiss Franc The Euro has fallen by 0.04% at 1.1277 EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar traded above JPY112 in early Asia, for the first time since early August but it could not take out the high recorded then (~JPY112.10) and has come off a bit in Europe. There is a $493 mln option struck at JPY112 that will expire...

Read More »A successful bank should be boring

The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from...

Read More »New long-haul budget airline from Basel launches fundraising

The idea is simple. Keep costs low by flying point-to-point, thus avoiding costly hubs, use one model of aircraft to contain pilot and aircraft maintenance costs, and charge passengers for everything from coffee to checked-in luggage. Southwest Airlines was first to launch the model and copycats like EasyJet followed. First transatlantic flight of an Airbus A321LR © Airbus Now a new, yet to be named, airline plans to...

Read More »Europe Starting To Reckon Eurodollar Curve

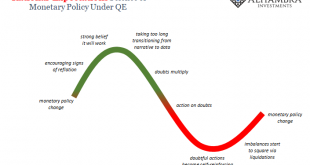

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy. The problem has been that officials mistake reflation for what it is. Each time they believe it...

Read More » SNB & CHF

SNB & CHF