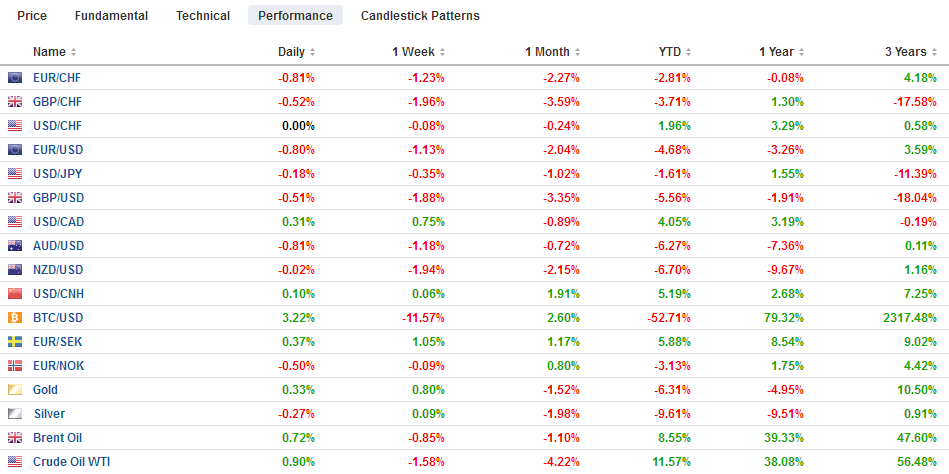

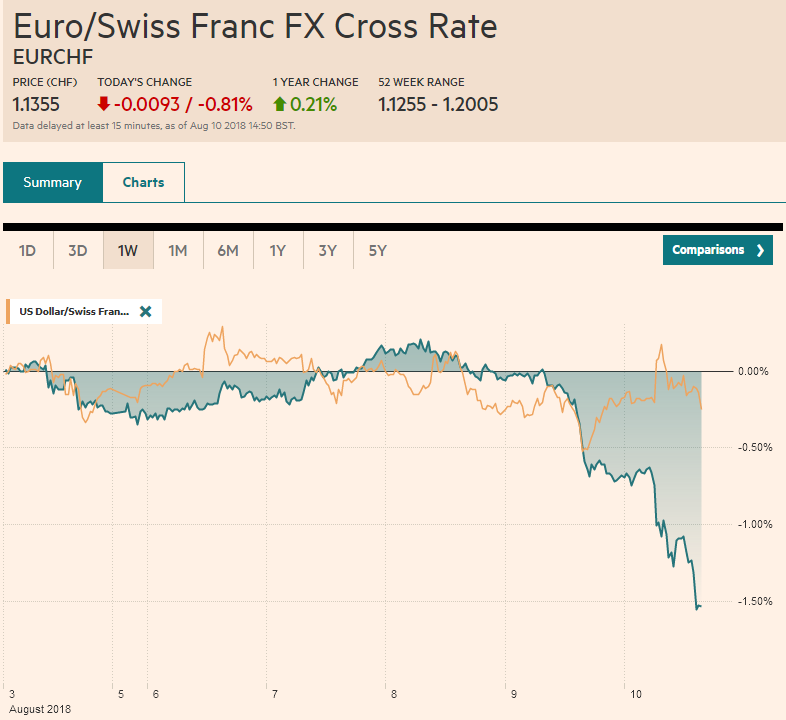

Swiss Franc The Euro has fallen by 0.81% to 1.1355. Even more than the dollar, the Swiss Franc has muscled today. EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government’s response as investors await officials to elaborate on the outline of the “new economic model” provided yesterday. Turkey’s five-year credit default swap, insurance, is more

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, GBP, JPY, newsletter, Turkey, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.81% to 1.1355. Even more than the dollar, the Swiss Franc has muscled today. |

EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government’s response as investors await officials to elaborate on the outline of the “new economic model” provided yesterday. Turkey’s five-year credit default swap, insurance, is more expensive than nearly all countries but Argentina and Venezuela. There are three possible ways out, it appears. First, Erdogan can take bold action to restore investor confidence. The “new economic model” is not it. Second, Turkey can go hat in hand to the IMF. However, not only would going to the IMF represent a big climb down for Erdogan, but the likely terms of the conditionality would be particularly loathsome as they would most likely require a return to orthodox policies, such as much higher interest rates and austerity. Third, Turkey could impose capital controls, which are seen as a way to buy time, but that time must be used to institute reforms. Therefore is best coupled with other measures or promises of bold action to right the economic ship of state. According to press reports, the ECB has identified three European banks with the most exposure to Turkey: BBVA, Unicredit, and BNP. Financials are among the biggest drags on the Dow Jones Stoxx 600, which is off about 0.8% in late European morning turnover. Core European 10-year benchmark yields are off around four basis points, while the periphery is lagging and Italy’s 10-year yield is up 2.5 bp. It came into the session flat on the week. The euro was sold off, with the $1.15 finally buckling and sending the single currency to almost $1.1430. Recall that our $1.1450 target corresponded to a 50% retracement of the euro’s rally that began in early 2017. The 61.8% retracement objective is found a little below $1.12. What was support frequently becomes resistance and the market may want to test the $1.15 breakout level. Similarly, the Dollar Index pushed above 96.05, where a similar (50%) retracement was found. The 61.8% objective is just shy of 98.00. The yen and Swiss franc are faring better. Their relative strength may be best understood as primarily driven by the unwinding risk trades where they are used as funding currencies. Japan also reported a stronger than expected Q2 GDP fueled by consumption and investment. The world’s third-largest economy grew 0.5% in Q2 rather than the 0.3% forecast. It offsets in full the 0.2% contraction posted in Q1. Consumption grew by 0.7%, the strongest in a year and follows a 0.2% decline in Q1. Business investment rose 1.3%, more than twice expectations and follows a 0.5% gain in Q1. Prices remain a challenge. The GDP deflator stood at 0.1% down from 0.5% in the previous quarter. |

FX Performance, August 10 |

Each day this week, the dollar recorded a lower low against the yen. Today’s low near JPY110.60 is the lowest in a little more than two weeks. It held just above the July 26 low, which itself was a three-week low. Additional support is seen near JPY110.30. Although the new lows for the week were recorded, the dollar has not broken and has returned to the JPY111.00 area in Europe. A close above JPY111.20 would lift the technical tone going into next week.

The UK released a raft of data, but it did not seem to make much of a difference. Sterling’s slide has extended into the seventh consecutive session, and like the euro, has recorded new lows for the year today (~$1.2735). The next area of chart support is seen in the $1.25-$1.26 area. The market may probe to see if the $1.28 support area now acts as resistance.

The UK reported a smaller than expected June trade deficit and a larger than expected gain in industrial output, manufacturing, and construction, though weaker services. The monthly GDP estimate for June was disappointing at 0.1% down from 0.3% in May. The Q2 GDP came in spot on expectations at 0.4%. Sterling decline by 5.8% in Q2 and exports fell 3.6%, the largest decline in six years. They were expected to have increased by 0.7%. Imports fell 0.8% and were expected to have risen by the same amount. It was the largest decline in UK imports in three years.

The Australian dollar has also been sold to new lows for the year today as the $0.7300 floor yielded to the risk-off mood. It fell to $0.7280 before finding a bid to poke back above the old floor. The New Zealand dollar has been unable to stabilize following the dovish central bank. It was sold below $0.6700 yesterday and fell through $0.6600 today. The $0.6620 area may offer initial resistance now.

Canada reports July employment figures today. It is expected to have grown around 17k jobs. The unemployment rate is forecast to slip to 5.9% from 6.0%. It has created an average of around 14k full-time positions in H1. The broad greenback gains have weighed on the Canadian dollar, which recouped nearly everything lost by the Saudi embargo. For the last two weeks, the US dollar has been flirting with the CAD1.30 level and has only managed to close below there once. The CAD1.3125 area offers initial resistance.

The US reports the July CPI figures. A 0.2% rise in the headline and core rates would keep the year-over-year rates steady at 2.9% and 2.3% respectively. Barring a significant surprise, the market will quickly look past the data.

Investors do not want tight or loose monetary policy. They want the policy that is appropriate for the economic conditions. Categories like hawks and doves are bandied about by economists and observers as if they are fixed natures rather than being contextual. So, when Evans who dissented from the decision to raise rates explains why policy may need to be restrictive albeit modestly, the economists paid attention.

Investors realized there was no real new information. The September and October fed funds futures contracts were unchanged for a third session. The implied yield of the January 2019 Fed funds futures contract actually eased 1.5 bp to a three-week low yesterday.

Oil prices are steady today and barring a significant rally today, oil will extend its losing streak to a sixth consecutive week. It is the longest push lower in three years. The two main weights appear to be coming from expectations that the world’s three largest producers, Russia, Saudi Arabia, and the US are boosting production, even if it is not all evident in the data yet, and fears that the escalated protectionism will slow growth and weaken demand. Iran, which was not eager for OPEC to boost output, has formally complained that some countries in OPEC are producing more than agreed upon.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,newsletter,Turkey,USD/CHF