Clariant has sealed a restructuring deal with its new large shareholder. Swiss specialty chemical maker Clariant has signed a memorandum of understanding to enter into a strategic partnership with Saudi Arabian firm SABIC. This will result in a major restructuring of the company along with changes in management and the board of directors. On Tuesday, Clariant said the collaboration will see the merger of units from both...

Read More »Monthly Macro Monitor – September

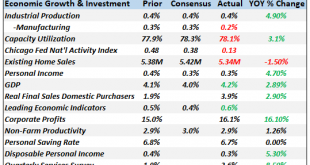

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about...

Read More »Digging into Wealth and Income Inequality

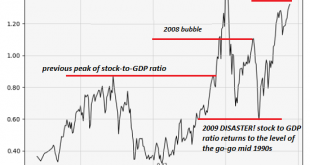

That changes our perspective on the wonderfulness of ever-expanding household wealth. The assets of U.S. households recently topped $100 trillion, yet another sign that everything is going swimmingly in the U.S. economy. Let’s take a look at the Federal Reserve’s Household Balance Sheet, which lists the assets and liabilities of all U.S. households in very big buckets (real estate: $25 trillion). (For reasons unknown,...

Read More »Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85 Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain “We believe that we are on the verge...

Read More »FX Daily, September 19: Dollar Trades Heavily as Emerging Markets Follow China

Swiss Franc The Euro has risen by 0.46% at 1.1303 EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar initially extended its gains against the yen, reaching JPY112.45 before some profit-taking was seen. There is a $1.7 bln option at JPY112 that expires today. It looks safe today after yesterday’s big outside up session-where the...

Read More »Unsere Nationalbank befeuert Dax und Wallstreet statt SMI

Im Januar 2010 betrugen die Devisenanlagen der Schweizerischen Nationalbank (SNB) 94 Milliarden Franken. Innerhalb der nächsten fünf Monate, also bis Mai 2010, explodierten diese auf 238 Milliarden. Das entspricht einem Plus von 150 Prozent (Faktor 2.5x). Was war geschehen? In ihrer vierteljährlichen Lagebeurteilung schrieb die SNB damals im März 2010: „Die Schweizer Wirtschaft hat im vierten Quartal 2009 und zu Beginn...

Read More »US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established. The chart below illustrates the situation – it compares the...

Read More »Swiss Housing – the hardest and easiest places to find a home

Recent government figures show a 13% rise in the number of vacant homes over the 12 months to June 2018. The number has more than doubled since 2009 when there were close to 35,000 vacant dwellings. By 1 June 2018, there were more than 72,000, a vacancy rate of 1.62%1 This might sound like good news for home buyers and renters, however it depends on where you hope to live. The municipality of Horw_© Laurentiu Iordache _...

Read More »We’re All Speculators Now

When the herd thunders off the cliff, most participants are trapped in the stampede.. One of the most perverse consequences of the central banks “saving the world” (i.e. saving banks and the super-wealthy) is the destruction of low-risk investments: we’re all speculators now, whether we know it or acknowledge it. The problem is very few of us have the expertise and experience to be successful speculators, i.e....

Read More »ROGUE INTERVIEWS: Charles Hugh Smith – Of Two Minds (09/17/2018)

ROGUE NEWS is a group of political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. !PLEASE SUBSCRIBE! Support our media by participating in our products and services: ► ROGUE NEWS: ROGUEMONEY.net ► Watch Us Trade: https://wut.page.link/wut1 ► CBD Edibles: https://mycbdedibles.com ► TRADE BTC: https://wut.page.link/liquidbase ► LIQUID CRYPTO:...

Read More » SNB & CHF

SNB & CHF