An assessment of the US economy is an important input into the expectations of the dollar’s behavior in the foreign exchange market. As a currency strategist, my views of the US economy are often subsumed in discussions or talked about indirectly by talking about Fed policy. However, in this clip with Alix Steel and David Westin, I have an opportunity to sketch outlook for the US economy. I agree with those that do...

Read More »The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down. Historically, 2.5% is about as low as inflation gets in a mass-consumption economy like...

Read More »Useless But Not Worthless, Report 21 Oct 2018

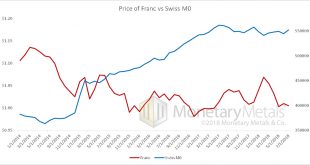

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal. They will never reach their...

Read More »2019 Slowdown Will Force Fed to Pause, Chandler Says

Oct.22 -- Marc Chandler, chief market strategist and managing partner at Bannockburn Global Forex, discusses the potential for a U.S. recession and looks at the Federal Reserve's rate path. He speaks on "Bloomberg Daybreak: Americas."

Read More »2019 Slowdown Will Force Fed to Pause, Chandler Says

Oct.22 -- Marc Chandler, chief market strategist and managing partner at Bannockburn Global Forex, discusses the potential for a U.S. recession and looks at the Federal Reserve's rate path. He speaks on "Bloomberg Daybreak: Americas."

Read More »FX Daily, October 22: Collective Sigh of Relief?

Swiss Franc The Euro has fallen by 0.24% at 1.1435 EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Dollar: After a slow start in Asia, the US dollar has turned better bid. The euro recovered from $1.1430 before the weekend to $1.1550 today, where an option for almost 525 mln euros expires today. There is another option (1.6 bln euros) at...

Read More »Switzerland: a country of dual nationals?

Every fifth Swiss has dual nationality. In Geneva, it's almost half of the population. Swiss public television, SRF took a closer look at why residents with foreign passports are keen on becoming naturalised. (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our...

Read More »Swiss Banks Curb China Travel After UBS Banker Arrested

Two major Swiss banks imposed restrictions on staff travel to China after a UBS employee was detained in the country, underscoring the challenges of doing business in a country which is a mecca for banks eager to capture and manage (for a generous fee) the fastest growing fortunes in the world, yet are challenged by a regime that tramples over civil rights. According to Bloomberg, UBS asked some bankers not to travel to...

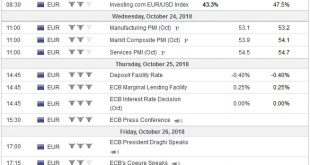

Read More »FX Weekly Preview: What Can Bite You This Week?

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the...

Read More »Mutiny, Class, Authority and Respect

Humiliation and fear of a catastrophic decline in status foment mutiny and rebellion. I recently finished The Bounty: The True Story of the Mutiny on the Bounty, a painstakingly researched history of the mutiny, but with a focus on how the story was shaped by influential families after the fact to save the life of one mutineer, Peter Haywood, and salvage the reputation of the leader, Fletcher Christian, via a carefully...

Read More » SNB & CHF

SNB & CHF