A Post bus on a route on the Flüela Pass in Graubünden (© KEYSTONE / PETRA OROSZ) - Click to enlarge The state-owned PostBus company is threatened with losing bus routes in several regions, following a scandal over illegal subsidies. Jura is the first canton that will put its 38 routes out to tender next spring, SonntagsZeitungexternal link has reported. “We were not convinced of the costs and quality of the post...

Read More »Investigating suspected welfare cheats – where to draw the line

On 25 November 2018, Swiss will vote on whether to accept laws allowing detectives to uncover welfare fraud. ©-Dan-Grytsku-_-Dreamstime.com_ - Click to enlarge Currently, there is nothing specific in Swiss law covering the practice. In the past, investigators have been used to gather evidence on disability and accident beneficiaries. Between 2009 and 2016, detectives were used on around 220 investigations a year, of...

Read More »Switzerland expecting a 2.5 billion franc federal surplus for 2018

© Marekusz | Dreamstime.com The latest figures forecast Switzerland’s federal spending for 2018 will be CHF 0.9 billion less than expected. This and higher than expected receipts of CHF 1.3 billion add up to an extra CHF 2.2 billion on top of an original budget surplus of CHF 0.3 billion, bringing the total forecast federal surplus to CHF 2.5 billion. Switzerland’s federal government is now expecting to spend CHF 70.2...

Read More »Charles Hugh Smith On Why Many Millennials Are Promoting Socialism

Click here for the full transcript: http://financialrepressionauthority.com/2018/10/26/the-roundtable-insight-charles-hugh-smith-on-why-many-millennials-are-promoting-socialism/ Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

Read More »Self-Employment declining in Switzerland

The percentage of Switzerland’s workers working for themselves has been slowly declining. In 2010, 13.7% of workers were self-employed. By 2017, the figure was 12.8% – self-employed includes those working as independents and those working for companies they own. Swiss (14.5%) are far more likely to be self-employed than foreigners (7.9%). This is partly explained by the low number of foreign farmers – farming is the...

Read More »Monthly Macro Monitor – October 2018 (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 Special Edition: Markets Under Pressure (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – September Monthly Macro Monitor – August Monthly Macro Monitor – August 2018 Global Asset...

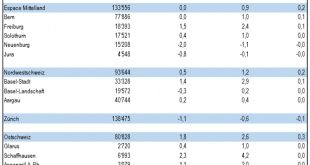

Read More »Contrasting growth in cantonal GDP in 2016

Neuchâtel, 25 October 2018 (FSO) – After a moderate 2015, economic growth increased slightly in most Swiss cantons in 2016. The most pronounced growth in the gross domestic product (GDP) was seen in the cantons of Vaud (+7.4%) and Schaffhausen (+4.2%). These results are taken from initial estimates of the Federal Statistical Office (FSO). Download press release: Contrasting growth in cantonal GDP in 2016 German Text:...

Read More »Swiss still World’s Richest

According to the annual wealth report produced by Credit Suisse, Switzerland leads on wealth per adult with US$ 530,240, comfortably ahead of second-placed Australia where the figure is US$ 411,060. The US is third with US$ 403,060. © Sam74100 | Dreamstime.com - Click to enlarge During the twelve months to mid-2018, aggregate global wealth rose by US$ 14.0 trillion to US$ 317 trillion, a growth rate of 4.6%. Wealth per...

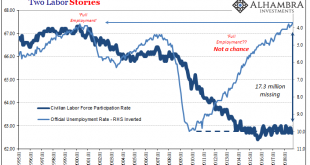

Read More »No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such. Before implying the benefits of broad...

Read More »Eastern Monetary Drought

Smug Central Planners Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten....

Read More » SNB & CHF

SNB & CHF