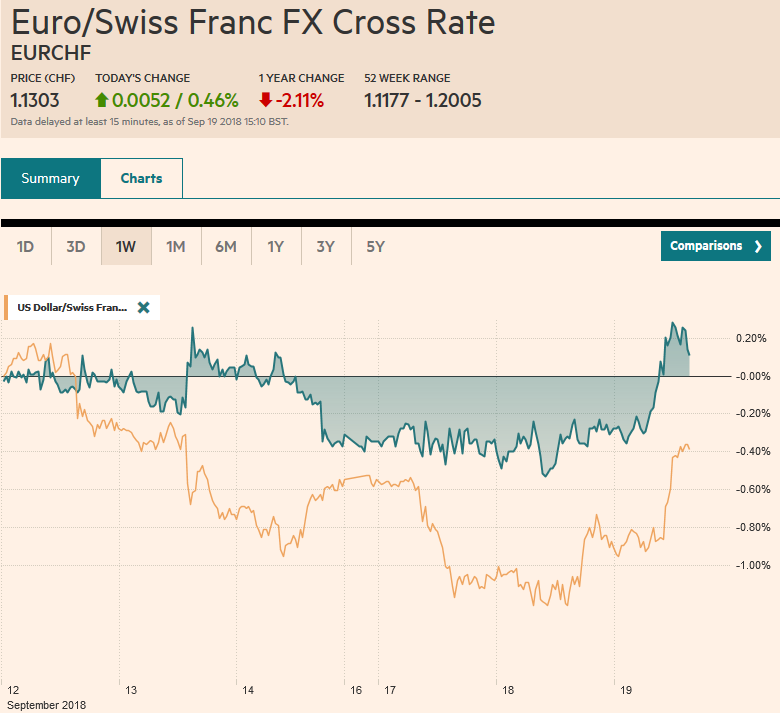

Swiss Franc The Euro has risen by 0.46% at 1.1303 EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar initially extended its gains against the yen, reaching JPY112.45 before some profit-taking was seen. There is a .7 bln option at JPY112 that expires today. It looks safe today after yesterday’s big outside up session-where the dollar traded on both sides of Monday’s range and finished above Monday’s highs. The market seems inclined to re-test those July highs above JPY113.00. The Australian dollar is the strongest of the major currencies, up about 0.4% for the third consecutive advance and the seventh in the past eight sessions.

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD, ZAR

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.46% at 1.1303 |

EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe dollar initially extended its gains against the yen, reaching JPY112.45 before some profit-taking was seen. There is a $1.7 bln option at JPY112 that expires today. It looks safe today after yesterday’s big outside up session-where the dollar traded on both sides of Monday’s range and finished above Monday’s highs. The market seems inclined to re-test those July highs above JPY113.00. The Australian dollar is the strongest of the major currencies, up about 0.4% for the third consecutive advance and the seventh in the past eight sessions. Near $0.7250, it is at its best level this month, and nearby resistance is seen near $0.7570. A break below $0.7225 would warn that the upside momentum has begun to flag. |

FX Performance, September 19 |

One would not have a clue looking at global equities that there has been a sharp escalation in trade tensions in the past 36 hours. As was well tipped the US imposed a 10% tariff on $200 bln of Chinese goods and indicated that the tariff will rise to 25% at the start of next year. President Trump also threatened to quickly follow up with another tariff on $267 bln of Chinese goods it retaliated.

China had already threatened to retaliate and specified the goods and tariff rate for $60 of US goods. How many advisers or informed observers would have predicted China would back down? Therefore, it seems reasonable to assume that the Trump Administration wanted to go ahead with the full enchilada ($50 bln +$200 bln+$267 bln). It continues to signal that in this Administration, the Treasury Department does not set policy.

Consider that before World War I, Mexico, Argentina, and Brazil were integrated into the world trading system. The Great War disrupted trade relations, and this helped facilitate the import-substitution developmental strategy. The US appears to be demanding nothing shy of China changing its developmental strategy. China cannot abide. No major power would. Of course, this does not mean China cannot do a better job protecting intellectual property rights.

It is interesting to look at some of the (~300) goods that were removed from US list (and none were added). There were many products for children, like high chairs, car seats, and playpens, a few Apple products (e.g., watch, and ear pod headphones), and rare earths. Many countries expressed disapproval China cut off its rare earth sales to Japan amidst a dispute. It appears to be a potential point of leverage. Yet the decline of $10 bln in Chinese holdings of US Treasuries is not linked to the trade tensions. Given its holdings and imprecision of the data, it is hardly a rounding error of its $1.17 trillion of US Treasuries. Moreover, its purchases of Agency bonds more than offset the decline in Treasury holdings.

China has pledged in recent months not to weaponize the yuan as part of the trade dispute. Premier Li reiterated that pledge today, and it seemed to helped sentiment, especially in Asia, where Chinese stocks participated in the regional rally. The Shanghai Composite advanced 1.1% today after 1.8% yesterday, the first back-to-back gain since late August and the best two-day performance in almost two months. Indeed the rally in Asia is lifting emerging markets stocks more broadly. The MSCI Emerging Markets Index is up about 0.7%, ahead of the Latam session. It is posting gains for the fifth session of the past six amid as bargain hunters try their hand again.

Economists are generally projecting that the full set of US tariffs will cut Chinese growth by around 0.7%. Those same tariffs and counter-tariffs will shave 0.4% off US growth. Chinese officials are expected to take measures aimed at mitigating the impact.

One of the causalities of the escalating trade tensions with China is the US-Japan bilateral talks, which have reportedly been postponed. Earlier today, Japan report that its August trade deficit was nearly twice the July shortfall (-JPY444.6 bln vs. -JPY231.2). Although exports rose 6.6% year-over-year, import growth was stronger still at 15.4%. Japan’s exports to the US rose 5.3%, but the JPY455.8 bln surplus it enjoyed as 14.5% below a year ago. Separately, the BOJ meeting came and went without much fanfare or news. As widely expected, there were no policy adjustments.

The EU is holding one of three summits in Salzburg on Brexit. The headlines coming from EU have generally been supportive and this aided sentiment. One gets a sense that real progress has been made. However, there is a sense of foreboding as what pleases the EU is unacceptable to parts of May’s Tory Party. There is little room for defection and Labour has claimed it will not provide what may prove to be the necessary votes.

Separately, the UK reported an unexpected acceleration in consumer prices. CPIH, which includes owner-occupied housing costs, rose to 2.4% from 2.2%, which is a bit more than forecast. CPI rose 0.7% in August, which matched the largest monthly increases since 2011. In both February 2017 and February 2013, the monthly CPI rose 0.7%. The year-over-year rate first to 2.7%. Recall that the year began with CPI at 3.0%. It fell to 2.4% throughout Q2 and August was the second consecutive increase in the year-over-year pace. Core price rose to 2.1% from 1.9%. In January, core inflation was at 2.7%. The market is pricing in about a 70% chance of a hike next May, which is a bit higher than yesterday, as the market expected the BOE to look through the pick-up.

Separately, the EU reported that auto registrations jumped 31.3% in August. This is huge. It is easily the most in the time series going back to 2004. The next closest was a 27% increase in November 2009. The car registrations are a proxy for car sales. The auto sector is helping extend the European equity rally. The Dow Jones Stoxx 600 is up smalls, but it is the fourth consecutive advance, which is the longest in two months.

The US dollar is lower against nearly all the world’s currencies today. Among the majors, the exception is the Swiss franc and Norwegian krone. Among the emerging market currencies, the notable exception is the Indonesian rupiah, which of off marginally.

The euro is at the upper end of its recent range near $1.17. Resistance is seen in the $1.1730 area. It has not been above $1.1750 since July 11. The intraday technical readings suggest that North American deals may first probe the downside after the euro failed to take out yesterday’s high (~$1.1725). Sterling tested two-month highs above $1.32 before beginning to consolidate. Support is seen in the $1.3140-$1.3160 area. With the US two-year premium at multi-year highs against both Germany and the UK, we expect the dollar’s pullback to remain shallow.

The lack of progress on NAFTA has not deterred the Canadian dollar. The US dollar posted a big outside down day against the Canadian dollar yesterday, closing convincingly below CAD1.30 and there has been follow-through selling today (to ~CAD1.2945). Last month’s low was a little below CAD1.29 and that represents the next target. Despite widespread expectation for the Bank of Canada to hike rates again next month, the US two-year premium over Canada is recording fresh two-month highs today (~65 bp).

Among the emerging market currencies, the Turkish lira, South African rand and Russian rouble are leading the recovery. While the lira is in well-worn ranges, the rand catches our eye. It is higher today for the ninth session of the past ten. However, the damage inflicted means that even with these modest gains, the rand is still not stronger than it was a week ago. While some consolidation is not surprising, a significant recovery ahead of the FOMC meeting in a week’s time, which will not only hike rates but may validate the June shift toward a December hike as well. The Fed cycle and the US policy mix are among the general headwinds on many emerging markets.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TRY,Featured,newsletter,ZAR