Swiss Franc The Euro has risen by 0.09% at 1.1401 EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: First, reports suggested that if China refused to make any trade concessions, the Trump-Xi meeting on the sidelines of the G20 meeting next month would not take the issue up. Fair enough. Then, new reports indicated that the White was...

Read More »KOF Economic Barometer: Upswing Sets a More Leisurely Pace

The KOF Economic Barometer fell in October after having risen in the previous month. At 100.1 points, the barometer is now as good as on its long-term average of 100.0. Since May of this year, the KOF Economic Barometer has thus been fluctuating around its long-term average. The Swiss economy is therefore in the coming months likely to grow with average rates. In October, the KOF Economic Barometer fell...

Read More »Doctors’ Salaries Exceed eEpectations

Radiologists are some of the best medical earners (Keystone) The salaries of self-employed doctors in Switzerland are around a third higher than previously thought, according to a study by the Federal Office of Public Health. The median wage is CHF257,000 ($258,000). However, certain specialists can earn considerably more: neurosurgeons, for example, take home a median salary of CHF697,000 and gastroenterologists...

Read More »Globalization Has Hollowed Out Rural America

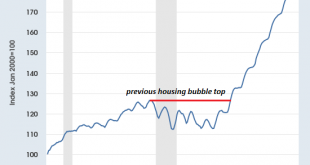

The value of local control and local capital far exceed the pathetic “savings” reaped from shoddy commoditized goods. What do we make of an economy in which a handful of bubblicious urban areas are magnets for jobs and capital while rural communities have been hollowed out? The short answer is that this progression of urbanization has been one of the core dynamics of civilization for thousands of years: opportunities...

Read More »Smart Valor tackles cryptocurrency volatility problem

Pegging cryptocurrencies to traditional currencies is seen by some to be the answer to price volatility. Cryptoasset trading platform Smart Valor plans to launch a new cryptocurrency pegged to the Swiss franc. The CHFt coin will join a growing list of so-called ‘stable coins’ designed to dampen the huge price swings of cryptocurrencies, such as bitcoin, which limits their everyday use. Smart Valor said on Monday that it...

Read More »FX Daily, October 29: Market Awaits US Leadership

Swiss Franc The Euro has risen by 0.08% at 1.1379 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Dollar index is trading within last Friday’s trading ranges. The year’s high, set on August 15, was just shy of 97.00. The euro continues to straddle the $1.14 level but is spending more time in Europe below there. There is a 1.5 bln euro...

Read More »What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / <insert favorite bugaboo here>. When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other...

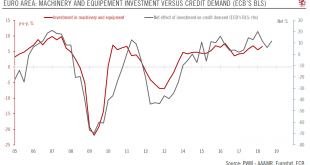

Read More »Credit Conditions in the Euro Area Remain Supportive of Investment Recovery

We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside. Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for...

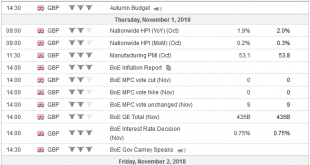

Read More »FX Weekly Preview: Thumbnail Sketch of Six Things to Monitor This Week

Equities Global equities have sold off hard. The magnitude of the recent loss is similar to what happened earlier this year. The MSCI World Index of developed countries fell 10.5% in January-February carnage and are now off about 11% this month. The MSCI Emerging Markets Index has matched the 11% loss back at the start of the year, but never truly recovering in between. The Dow Jones Stoxx 600 fell around 9% initially...

Read More »What’s the Real Meaning of the Stock Market Swoon?

Nobody dares discuss it openly for fear of triggering a panic, but there aren’t enough lifeboats for everyone. There’s no shortage of explanations on the whys and wherefores of the US stock market’s recent swoon / swan-dive / plummet. Here’s a few of the many credible explanations: the economy has reached peak earnings so there’s no fundamentals-driven upside left; bond yields are now high enough to dampen enthusiasm...

Read More » SNB & CHF

SNB & CHF