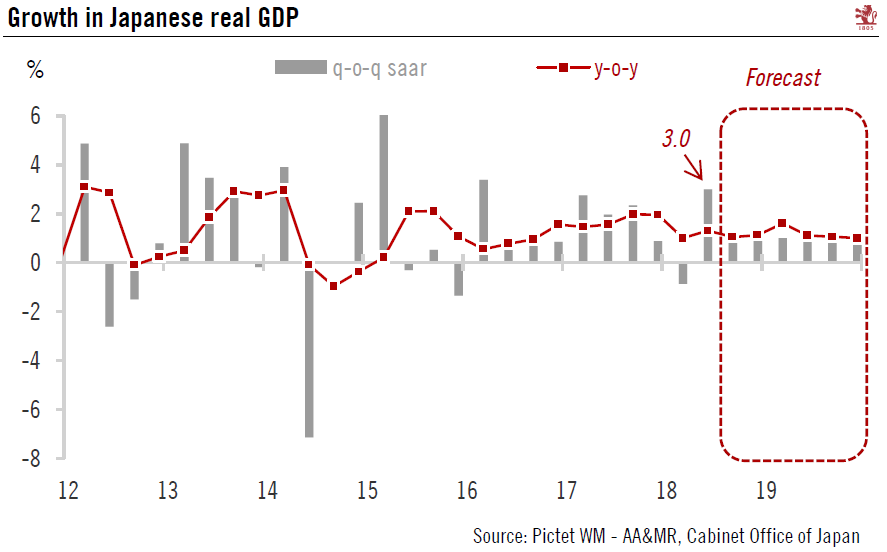

The revised figures mean a slight rise in our 2018 growth forecast. However, external uncertainties remain.The second estimate of the Japanese Q2 GDP coming in at 3.0% quarter-over-quarter annualised in Q2, a significant upward revision from the first estimate of 1.9%. This is Japan’s highest growth rate in nine quarters.The biggest revision was in corporate capital expenditure, which rose by 12.8% year over year (y-o-y) in Q2, according to the latest estimate. It contributed 1.7 percentage points to headline growth, significantly higher than the first estimate of 0.7%. Capital investment was especially strong in the manufacturing sector in Q2, rising nearly 20% y-o-y, while in non-manufacturing capital expenditure grew 9.2%. Another trend worth underlining is the strong growth in

Topics:

Dong Chen considers the following as important: Japan GDP forecast, Japanese growth, Japanese Q2 GDP, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The revised figures mean a slight rise in our 2018 growth forecast. However, external uncertainties remain.

The second estimate of the Japanese Q2 GDP coming in at 3.0% quarter-over-quarter annualised in Q2, a significant upward revision from the first estimate of 1.9%. This is Japan’s highest growth rate in nine quarters.

The biggest revision was in corporate capital expenditure, which rose by 12.8% year over year (y-o-y) in Q2, according to the latest estimate. It contributed 1.7 percentage points to headline growth, significantly higher than the first estimate of 0.7%. Capital investment was especially strong in the manufacturing sector in Q2, rising nearly 20% y-o-y, while in non-manufacturing capital expenditure grew 9.2%. Another trend worth underlining is the strong growth in software investment. In many cases, such investment involved new labour-saving technologies, as the unemployment rate in Japan is at its lowest since the 1990s (2.5% in July) and wage growth is on the rise.

Looking forward, we expect domestic demand in Japan to remain solid. However, more uncertainties are looming on the external front, with the Trump administration ramping up tariff threats against China and potentially Japan as well. While Japan is not currently at the heart of international trade disputes, any potential disruption on the global supply chain could cause damage to Japanese exporters. In addition, Japan’s export sector could suffer if the trade war starts to hurt corporate sentiment and causes delays in global capital investment.

The upward revision in the Q2 GDP figures mechanically pushes up our 2018 GDP forecast for Japan to 1.1%, up from our previous estimate of 1.0%. At the same time, however, we remain aware of the potential downside risk to the Japanese economy from external factors.