But there is room for further improvement.This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area. One development of note is that employment growth has been broad, including many countries that were hard hit by the crisis. Spain and Germany have contributed to approximately 50% of the total increase in euro area employment.Employment is a lagging indicator. Nevertheless, leading indicators such as the employment component in the Markit PMI surveys suggest that despite the euro area growth slowdown in the first half of the year, job

Topics:

Nadia Gharbi considers the following as important: euro area domestic demand, Euro area employment, euro area labour market, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

But there is room for further improvement.

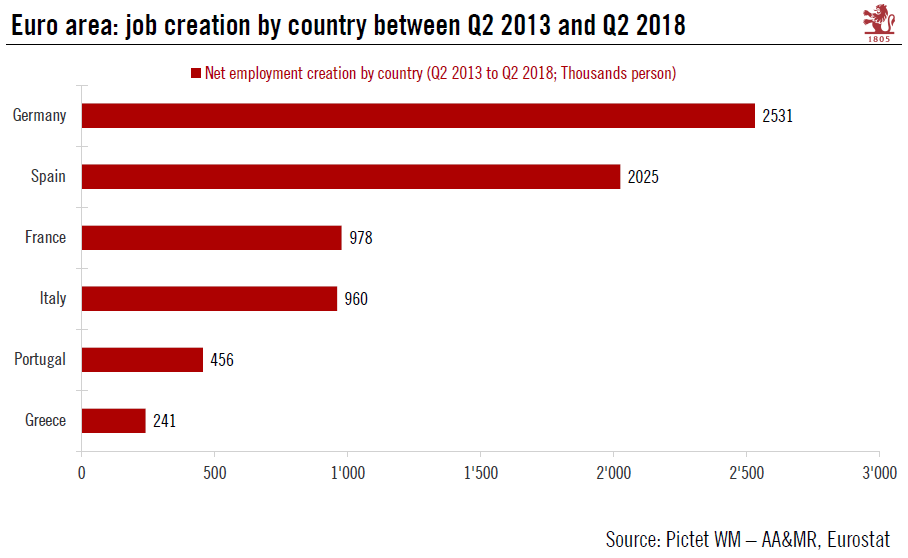

This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area. One development of note is that employment growth has been broad, including many countries that were hard hit by the crisis. Spain and Germany have contributed to approximately 50% of the total increase in euro area employment.

Employment is a lagging indicator. Nevertheless, leading indicators such as the employment component in the Markit PMI surveys suggest that despite the euro area growth slowdown in the first half of the year, job creation will continue in the coming months, albeit at a slightly slower pace.

Importantly, labour market strength is also increasingly translating into a rising wage stimulus. The three main euro area labour cost indicators – negotiated wages, compensation per employee and hourly labour costs are moving up.

Labour market improvement and rising wages are the main drivers of private consumption and likely to continue in the coming months. Moreover, accommodative financing conditions add further support to investment. As a result, the strength in domestic demand is expected to mitigate the downside risks from external weakness.