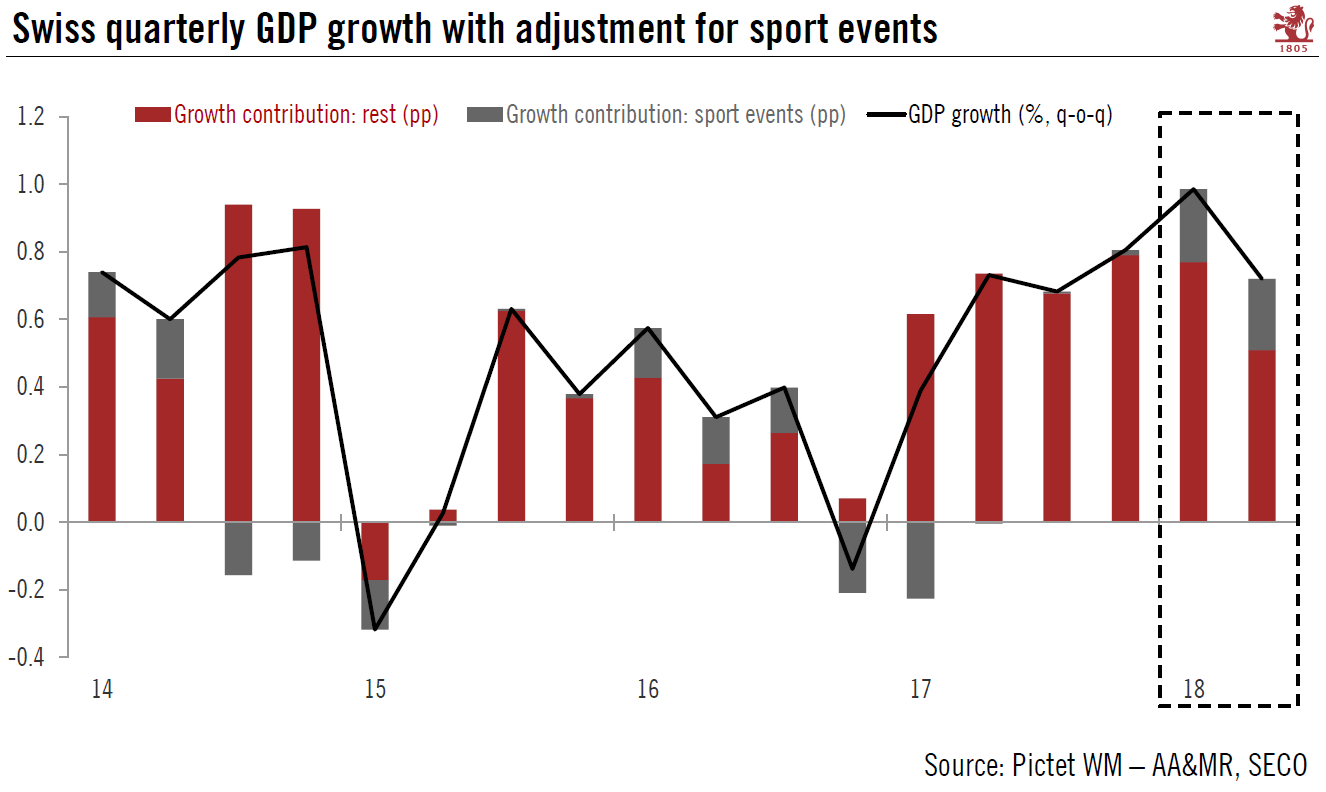

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010. Nevertheless, GDP was again boosted by special factors, namely sports events, which added 0.2 percentage points to quarterly growth in both Q1 and Q2. Second, domestic demand and imports were on the weak side in Q2, with private consumption growth slowing. Regarding trade, exports enjoyed a robust growth, while imports contracted. Manufacturing sectors provided the most substantial boost to growth

Topics:

Nadia Gharbi considers the following as important: Macroview, manufacturing, Sports economy, Swiss GDP growth, Swiss National Bank

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.

The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010. Nevertheless, GDP was again boosted by special factors, namely sports events, which added 0.2 percentage points to quarterly growth in both Q1 and Q2. Second, domestic demand and imports were on the weak side in Q2, with private consumption growth slowing. Regarding trade, exports enjoyed a robust growth, while imports contracted. Manufacturing sectors provided the most substantial boost to growth in Q2, and the entertainment sector again provided a sharp boost to growth, with sports events adding 0.2 pp to quarterly growth in both Q1 and Q2.

Looking ahead, our scenario remains unchanged. We expect the Swiss economy to grow at a robust, although slower pace in H2 2018 as the effect of some factors (namely sports events), is likely to fade. Indeed, the experience of prior years with major sports events suggests that growth will be much weaker in Q3 and Q4. Moreover, the recent strengthening of the franc, somewhat weaker euro area growth and uncertainty regarding global trade tensions suggest slower growth momentum ahead. Nonetheless, given the significant upward revisions in Q1 and 2017 data, our GDP growth forecast is pushed up to 2.9% in 2018 (from 2.0% previously).

Average headline inflation in Q2 was 0.1 pp above the Swiss National Bank (SNB)’s June projections. In addition, inflation pick-up in July and August (1.2% y-o-y) suggests that the Q3 average is also likely to be above the SNB’s Q3 forecast of 0.9%. This could push the SNB to marginally revise up its 2018 CPI forecast at its next meeting in September 20. Nevertheless, we expect the SNB to maintain its accommodative monetary policy and we foresee the first SNB policy rate hike (+25 bp increase) in September 2019.