Regarding US trade, there are two key recent pieces of news and one major source of uncertainty.The first is the bilateral trade deficit with China, which rose to a new high: USD 393 billion in the twelve months to July, with imports of USD 529 billion, according to US customs data. The second is that Trump’s focus is increasingly on the imports of consumer electronics, as he has recently threatened to cover a major consumer electronics brand (and importer) with levies. Bizarrely, electronics like phones and tablets, which have been the main driver of the bilateral trade deficit widening in recent years, were not included in the new tranche of tariffs on China (USD 200 billion) formulated over the summer. But it seems that the mood has now shifted in the White House, perhaps as officials

Topics:

Thomas Costerg considers the following as important: China-US trade, Macroview, Trade tariffs, US trade deficit

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Regarding US trade, there are two key recent pieces of news and one major source of uncertainty.

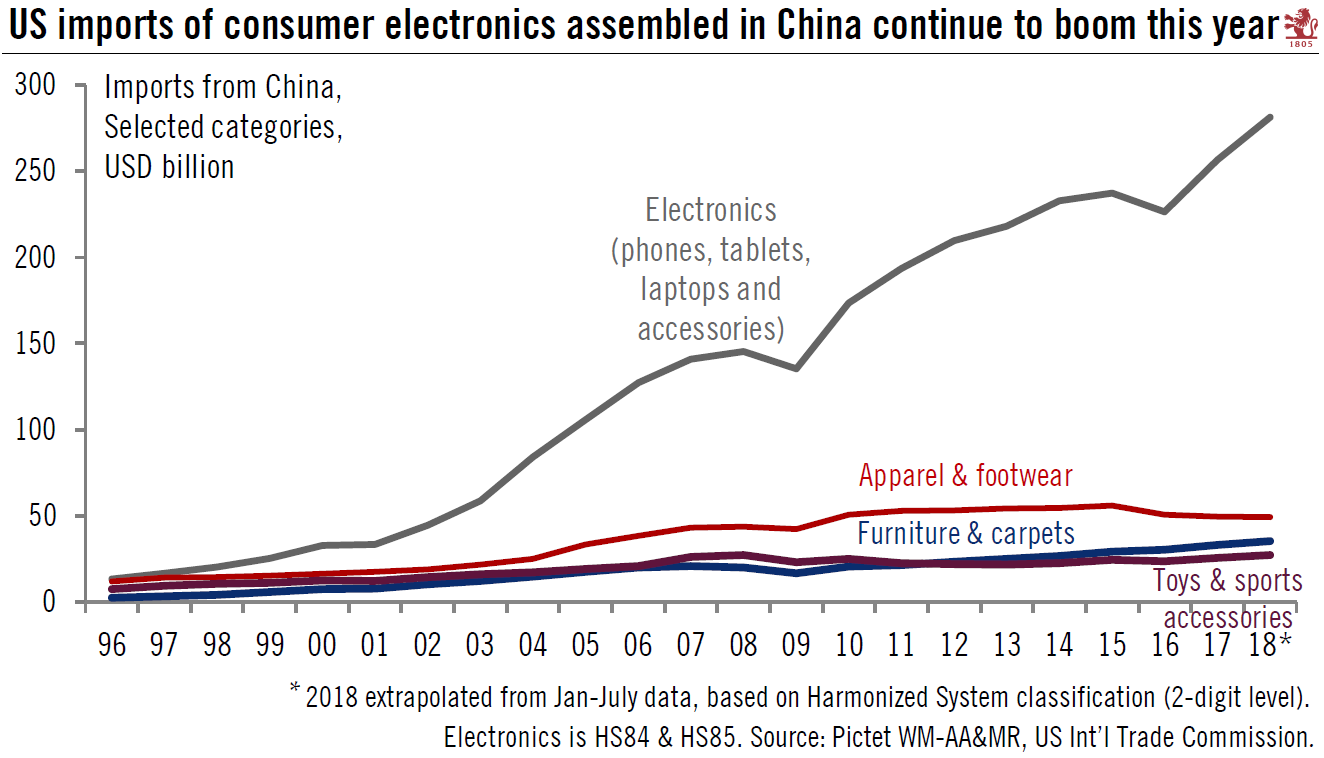

The first is the bilateral trade deficit with China, which rose to a new high: USD 393 billion in the twelve months to July, with imports of USD 529 billion, according to US customs data. The second is that Trump’s focus is increasingly on the imports of consumer electronics, as he has recently threatened to cover a major consumer electronics brand (and importer) with levies. Bizarrely, electronics like phones and tablets, which have been the main driver of the bilateral trade deficit widening in recent years, were not included in the new tranche of tariffs on China (USD 200 billion) formulated over the summer. But it seems that the mood has now shifted in the White House, perhaps as officials look at the trade deficit with more granularity.

Looking at big categories of imports from China (see Chart), consumer electronics remain the bulk of imports composing USD 257 billion out of the USD 505 billion of goods imported from China last year. These imports are up 9.6% so far this year, which suggests a continued deterioration in the deficit ahead. Imports of apparel (USD 50 billion in 2017), are down 0.4% this year, while furniture (USD 33 billion in 2017), are up 6.9% this year.

The key uncertainty relates to whether the White House will go ahead with the next tranche of tariffs on USD 200 billion of goods from China, whether the import net is increased (as recently threatened) and what the levy rate will be (10% or 25%, both of which have been threatened by Trump).