Fading policy headwinds has been helping growth numbers, but external factors are expected to weigh on growth in the near future.Indian GDP came in strongly in Q2, expanding 1.9% quarter-over-quarter and 8.2% year-over-year (y-o-y), beating both the consensus and our own forecast. These numbers put India easily at the top of G20 countries in terms of GDP growth. As a result, we are revising our Indian GDP forecast for fiscal year 25018-2019 slightly upwards to 7.6% from 7.5%.The acceleration in Indian growth is partly due to fading policy headwinds. Two have likely been of particular significance. First, in November 2016, the government started its “demonetisation” campaign by declaring all 500 and 1000 rupee banknotes invalid overnight, triggering a large-scale shortage of cash and

Topics:

Dong Chen considers the following as important: Demonetisation, India economy, India GDP, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fading policy headwinds has been helping growth numbers, but external factors are expected to weigh on growth in the near future.

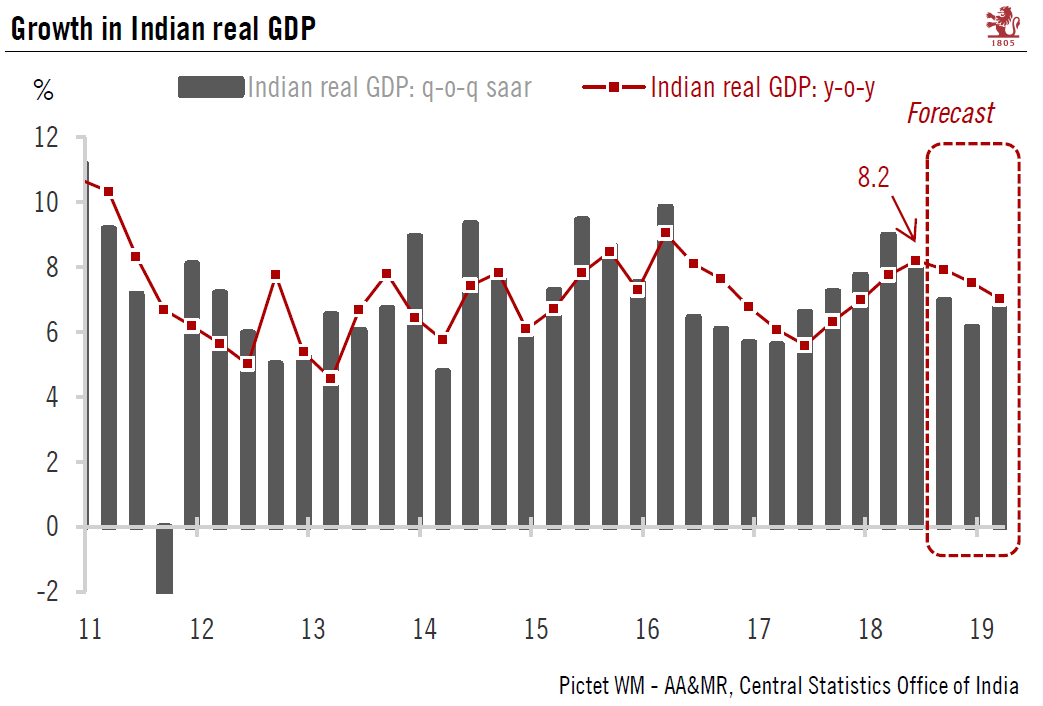

Indian GDP came in strongly in Q2, expanding 1.9% quarter-over-quarter and 8.2% year-over-year (y-o-y), beating both the consensus and our own forecast. These numbers put India easily at the top of G20 countries in terms of GDP growth. As a result, we are revising our Indian GDP forecast for fiscal year 25018-2019 slightly upwards to 7.6% from 7.5%.

The acceleration in Indian growth is partly due to fading policy headwinds. Two have likely been of particular significance. First, in November 2016, the government started its “demonetisation” campaign by declaring all 500 and 1000 rupee banknotes invalid overnight, triggering a large-scale shortage of cash and severe disruption to the real economy.

A second source of disruption was the introduction of a nationwide goods and services tax (GST) system in fiscal year 2017. We believe the new system will likely bring significant benefits to the Indian economy in the long term, as it creates an integral national market and makes doing business easier with a simpler and uniform tax code. However, the GST’s implementation has dislocated business in the short term. As both these headwinds have started to fade, the Indian economy has staged a rebound.

Looking forward, we expect India’s growth momentum to moderate through the rest of 2018 as policy relief fades and some external headwinds weigh on growth. Notably, elevated crude oil prices continue to exert pressure on India growth and inflation. Since oil prices bounced back from their recent trough in early 2016, India’s trade balance has been deteriorating and its current account deficit has been widening in recent years.