A challenging global environment has sapped the appeal of all the EM currencies we track.There have been few changes in our emerging market (EM) currencies scorecard over the past month. Currently, it suggests that no EM currency at present is particularly attractive on a 12-month horizon.August was a particularly harsh month for EM currencies, with the Argentinian peso and the Turkish lira both dropping 25% against the US dollar. While these two currencies were particularly vulnerable to a shift in investors’ sentiment given their weak external buffers (e.g. large current account deficit and inadequacy of FX reserves to short-term external debt), risk-off sentiment spread to other EM currencies. In particular, despite having strong external buffers, the Brazilian real and the Russian

Topics:

Luc Luyet considers the following as important: EM currencies, EM FX scorecard, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A challenging global environment has sapped the appeal of all the EM currencies we track.

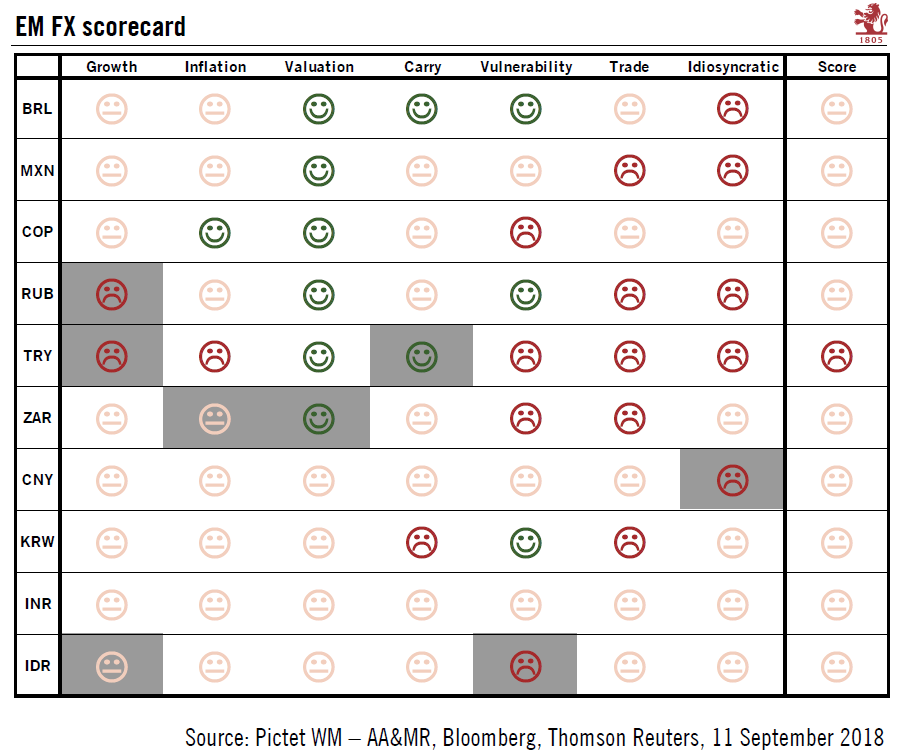

There have been few changes in our emerging market (EM) currencies scorecard over the past month. Currently, it suggests that no EM currency at present is particularly attractive on a 12-month horizon.

August was a particularly harsh month for EM currencies, with the Argentinian peso and the Turkish lira both dropping 25% against the US dollar. While these two currencies were particularly vulnerable to a shift in investors’ sentiment given their weak external buffers (e.g. large current account deficit and inadequacy of FX reserves to short-term external debt), risk-off sentiment spread to other EM currencies. In particular, despite having strong external buffers, the Brazilian real and the Russian rouble also depreciated significantly against the dollar. The threat of additional US sanctions against Russia penalised the rouble, while a volatile Brazilian general election campaign has hurt the real, especially as fiscal reform is much needed. Given the South African rand also declined heavily in August (-10%), there were not a lot of places for investors to hide in EM currencies.

As a reminder, our scorecard is designed to assess the attractiveness of a given currency over the coming 12 months. Constructed using a rules-based methodology, it ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks.

The most positive development during the month was in China, where the People’s Bank of China has taken measures to stabilise the renminbi (notably by re-introducing its so-called ‘counter cyclical adjustment factor’). These measures have reduced investors’ concerns about the currency being used as a weapon in China’s ongoing trade dispute with the US.

Two changes to our EM scorecard deserve to be highlighted: first, the South African rand has moved into significant undervaluation territory. Second, signals of external vulnerabilities are turning negative for Indonesia.

Potential triggers that could improve investor sentiment toward EM currencies overall are unlikely to materialize before the end of October. We therefore retain our cautious view on EM currencies over the very short term.