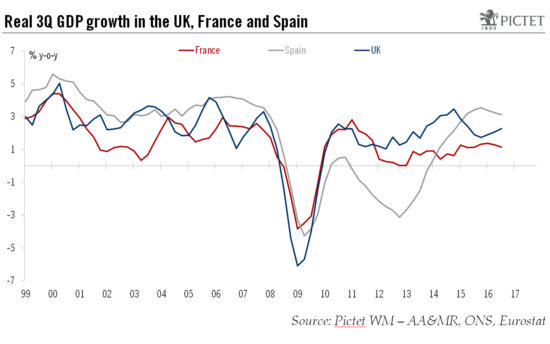

While growth in the UK and Spain is proving resilient, it is expected to slow in both places next year, while growth in France will remain moderate.This week saw the release of preliminary third-quarter GDP numbers in the UK, France and Spain. Following stronger-than-expected GDP growth (+0.5% q-on-q in the third quarter), we have revised our growth forecast for the UK higher, to 2.0% in 2016, (up from an earlier estimate of 1.8%). However, we still expect the fallout from the Brexit referendum to more fully materialise in H1 2017, resulting in a much weaker pace of economic expansion. We now expect the UK economy to grow by 1.1% in 2017, compared with an earlier forecast of 0.9%.Although our expectation is that the Bank of England (BoE) will remain cautious in its assessment of the medium-term effects of a possible hard Brexit, we don’t now expect any expansion of quantitative easing and we may not see a rate cut before Q1 2017, with a risk that it is postponed even longer. The focus will soon shift to the autumn budget statement on 23 November, with the potential for some positive announcement to revise our (and the BoE’s) growth forecasts marginally higher for next year.In France, real GDP expanded by 0.2% q-o-q in Q3, below consensus expectations (0.3% q-o-q).

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: European GDP, French GDP, Macroview, Spanish GDP, UK GDP

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While growth in the UK and Spain is proving resilient, it is expected to slow in both places next year, while growth in France will remain moderate.

This week saw the release of preliminary third-quarter GDP numbers in the UK, France and Spain.

Following stronger-than-expected GDP growth (+0.5% q-on-q in the third quarter), we have revised our growth forecast for the UK higher, to 2.0% in 2016, (up from an earlier estimate of 1.8%). However, we still expect the fallout from the Brexit referendum to more fully materialise in H1 2017, resulting in a much weaker pace of economic expansion. We now expect the UK economy to grow by 1.1% in 2017, compared with an earlier forecast of 0.9%.

Although our expectation is that the Bank of England (BoE) will remain cautious in its assessment of the medium-term effects of a possible hard Brexit, we don’t now expect any expansion of quantitative easing and we may not see a rate cut before Q1 2017, with a risk that it is postponed even longer. The focus will soon shift to the autumn budget statement on 23 November, with the potential for some positive announcement to revise our (and the BoE’s) growth forecasts marginally higher for next year.

In France, real GDP expanded by 0.2% q-o-q in Q3, below consensus expectations (0.3% q-o-q). The breakdown of France’s GDP was less upbeat than the headline number, with private consumption stagnating and investment by non-financial corporations declining for the second quarter in a row. We expect France to continue to record moderate growth in 2017

GDP growth for Spain was more impressive. The Spanish economy grew by 0.7% q-o-q in Q3, in line with expectations. The latest indicators point to robust GDP growth again in Q4. The economy is likely to continue to outperform the euro area this year and next, with real GDP growth of more than 3.0% in 2016 and 2.3% in 2017.

Overall, Spanish and French GDP figures are consistent with a +0.3% q-o-q reading for euro area Q3 GDP growth (to be published on 31 October).