PMI data in China has continued to move higher, meaning the near-term outlook is strong, but tighter controls on the property sector and on monetary policy point to a slowdown in the second half.The official PMI figures for manufacturing and nonmanufacturing rose again in March, extending a rebound that has been evident since early 2016. Sub-indices also remain on a solid upward trend, with the production and new order sub-indices reaching their highest levels since mid-2014 and the new export order index his highest level since March 2012.Overall, the March PMI report points to solid momentum in the Chinese economy in the near term, despite the government’s stepping-up of efforts to cool the housing market and rising interest rates in recent months. Looking further ahead, however, we are not convinced that the economy can continue to defy gravity in the face of a likely property market slowdown and the People’s Bank of China’s (PBoC) tightening policy bias as it bids to curb rising financial risks.After a massive rise in property prices in 2016, the government has stepped up measures to curb speculation in the housing market. The home purchase restrictions have now been extended to almost all second-tier cities and even some third-tier ones.

Topics:

Dong Chen considers the following as important: China growth forecast, China PMI, Chinese manufacturing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

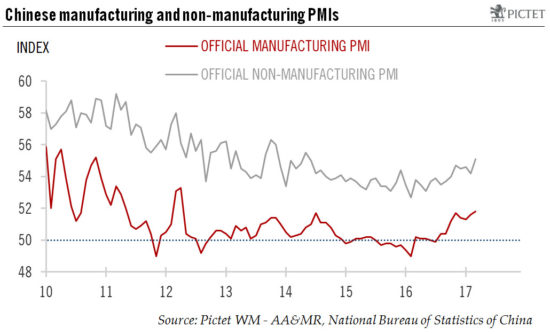

PMI data in China has continued to move higher, meaning the near-term outlook is strong, but tighter controls on the property sector and on monetary policy point to a slowdown in the second half.

The official PMI figures for manufacturing and nonmanufacturing rose again in March, extending a rebound that has been evident since early 2016. Sub-indices also remain on a solid upward trend, with the production and new order sub-indices reaching their highest levels since mid-2014 and the new export order index his highest level since March 2012.

Overall, the March PMI report points to solid momentum in the Chinese economy in the near term, despite the government’s stepping-up of efforts to cool the housing market and rising interest rates in recent months. Looking further ahead, however, we are not convinced that the economy can continue to defy gravity in the face of a likely property market slowdown and the People’s Bank of China’s (PBoC) tightening policy bias as it bids to curb rising financial risks.

After a massive rise in property prices in 2016, the government has stepped up measures to curb speculation in the housing market. The home purchase restrictions have now been extended to almost all second-tier cities and even some third-tier ones. While property sales were still buoyant as of February, these newly-introduced tightening measures will likely lead to a significant correction in transactions in the near term and have an impact on property investment, possibly starting in H2 2017.

At the same time, the PBoC will likely maintain a tightening bias in its monetary policy through 2017. As the Fed has embarked on its own rate tightening, the room for the Chinese central bank to ease its monetary policy is limited. Indeed, we are already seeing signs that the PBoC is moving in tandem with the Fed by pushing Chinese interest rates higher to contain capital outflows and to alleviate depreciation pressure on the renminbi. In addition, the concerns about rapidly rising financial leverage has led the PBoC to put more restrictions on inter-bank businesses, which has resulted in a surge in inter-bank interest rates in recent weeks. The tightening monetary conditions will likely weigh on China’s growth going forward. With these considerations in mind, we are maintaining our forecast of 6.2% GDP growth for China in 2017.