Euro area headline inflation declined by a larger margin than expected. Our main explanation is related to statistical effects.Euro area headline inflation declined for the first time in almost a year, by a larger margin than expected by the consensus. Headline HICP eased to 1.5% in March, from 2.0% in February, while core HICP inflation (excluding energy, food, alcohol and tobacco) dropped to a two-year low of 0.67% y-o-y, from 0.86% in February. The harmonised inflation rate dropped by 70bp in Germany (to 1.5%), by 90bp in Spain (to 2.1%) and by 30bp in Italy (to 1.3%). It remained stable in France (at 1.4%) as a sales discount effect was reversed.The main explanation for the disappointing core inflation figure is related to statistical effects, in our view, including the timing of the Easter break in Germany which should be reversed next month as services prices rebound (transportation, restaurants, package holidays). We forecast headline inflation to rebound to 1.7% in April, with core inflation up to 1.0%.Looking ahead, the outlook for price stability remains uncertain despite the stronger economic recovery. This should help ECB doves in the short term, although we continue to expect a change in communication at the June meeting, including a more neutral balance of risks and an adjustment in forward guidance on the deposit rate.

Topics:

Frederik Ducrozet considers the following as important: core euro inflation, euro area headline inflation, HICP inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area headline inflation declined by a larger margin than expected. Our main explanation is related to statistical effects.

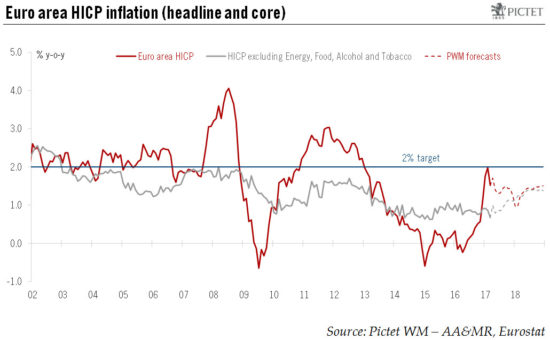

Euro area headline inflation declined for the first time in almost a year, by a larger margin than expected by the consensus. Headline HICP eased to 1.5% in March, from 2.0% in February, while core HICP inflation (excluding energy, food, alcohol and tobacco) dropped to a two-year low of 0.67% y-o-y, from 0.86% in February. The harmonised inflation rate dropped by 70bp in Germany (to 1.5%), by 90bp in Spain (to 2.1%) and by 30bp in Italy (to 1.3%). It remained stable in France (at 1.4%) as a sales discount effect was reversed.

The main explanation for the disappointing core inflation figure is related to statistical effects, in our view, including the timing of the Easter break in Germany which should be reversed next month as services prices rebound (transportation, restaurants, package holidays). We forecast headline inflation to rebound to 1.7% in April, with core inflation up to 1.0%.

Looking ahead, the outlook for price stability remains uncertain despite the stronger economic recovery. This should help ECB doves in the short term, although we continue to expect a change in communication at the June meeting, including a more neutral balance of risks and an adjustment in forward guidance on the deposit rate.