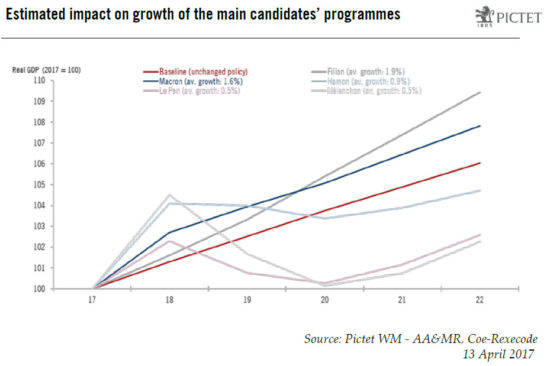

While our central scenario discounts the possibility of Marine Le Pen becoming president, her presence in the second round of the presidential election is likely to create considerable nervousness for investors.Our main scenario, a win for a Europhile politician in the second round of the French presidential elections in May, could result in a small relief rally on markets. However, the National Front’s Marine Le Pen is seen as being one of the two candidates to go through from the first round next Sunday to the second round, causing unease on financial markets.Le Pen can probably only hope to win that second round if voter participation collapses. In the unlikely event that she does win, markets would be considerably shaken.On FX markets, the euro would likely fall by about 6% to 13% against the US dollar on a 1-month horizon, probably taking the EUR/USD below parity (barring a significant rise ahead of the elections).French equities are fully integrated in European stock markets (one-third of the Euro Stoxx and one-sixth of the Stoxx 600) and a Le Pen victory would create fears not just for France but for Europe as a whole. Short-term volatility levels are inflated, but investors have not hedged aggressively. As a result, depending on the extent of the currency move, a pull-back of between 5% and 15% is possible.

Topics:

Perspectives Pictet considers the following as important: french election hypotheses, french election scenarios, Le Pen win, Le Pen win and markets, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While our central scenario discounts the possibility of Marine Le Pen becoming president, her presence in the second round of the presidential election is likely to create considerable nervousness for investors.

Our main scenario, a win for a Europhile politician in the second round of the French presidential elections in May, could result in a small relief rally on markets. However, the National Front’s Marine Le Pen is seen as being one of the two candidates to go through from the first round next Sunday to the second round, causing unease on financial markets.

Le Pen can probably only hope to win that second round if voter participation collapses. In the unlikely event that she does win, markets would be considerably shaken.

On FX markets, the euro would likely fall by about 6% to 13% against the US dollar on a 1-month horizon, probably taking the EUR/USD below parity (barring a significant rise ahead of the elections).

French equities are fully integrated in European stock markets (one-third of the Euro Stoxx and one-sixth of the Stoxx 600) and a Le Pen victory would create fears not just for France but for Europe as a whole. Short-term volatility levels are inflated, but investors have not hedged aggressively. As a result, depending on the extent of the currency move, a pull-back of between 5% and 15% is possible.

In fixed income, there would be contagion to the euro area periphery, and France would lose its semi-core status. Foreign investors could sell off on French government debt. Rising fears of a euro-area break-up would likely push 10-year sovereign bond spreads to about 200bp for France, 250bp for Spain and 300bp for Italy. Assuming that the 10-year Bund yield fell back to 0%, this would translate into 10-year yields of around 2% for French, 2.5% for Spanish and 3.0% for Italian government bonds.

But can Le Pen win? Probably only if voter participation collapses. For Le Pen to win in the second round, based on regular turnout of around 80%, she would need an additional 7 to 8 million votes on top of the roughly 11 million votes we think she will win in the first round. In the event of a Le Pen win, we would be well served by the protection that we added in March—derivative protection on euro high yield corporate bonds and a call option on gold for discretionary portfolios—as well as our long dollar position and underweight on European bonds.