Shale oil has forced the conventional oil industry to reinvent itself. Companies have nevertheless demonstrated terrific powers of adaptation, helped by the high-tech nature of the oil industry.In a ‘lower-for-longer price’ environment, there are still attractive themes and equity stories to play, assuming prices remain broadly above USD45-50 per barrel. Valuations generally remain reasonable, especially on the back of the correction since the start of the year. The growth theme is clearly the shale oil story, where both producers and services companies look well positioned—whatever the oil price, shale oil producers will remain the relative winners. Among ‘the rest’ of the oil sector, the large integrated oil majors look the most attractive investment opportunity, albeit not a growth category but more a yield story.The shale oil industry was hit hard by the price slump of the past two years, but the survivors have shifted downwards on the cost curve, thanks to efficiencies and technological progress. Over the long term, we expect further efficiencies to be realised. As a result, US shale output may rise by close to 1m barrels per day (b/d) over the next few years, enough to meet the bulk of global demand growth (1.3m b/d). Across the industry, most companies are positioning for ‘lower-for-longer’ oil prices.High-risk exploration is now a story of the past.

Topics:

Perspectives Pictet considers the following as important: Macroview, oil industry, oil prices, us shale oil production

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Cesar Perez Ruiz writes Weekly View – Big Splits

Shale oil has forced the conventional oil industry to reinvent itself. Companies have nevertheless demonstrated terrific powers of adaptation, helped by the high-tech nature of the oil industry.

In a ‘lower-for-longer price’ environment, there are still attractive themes and equity stories to play, assuming prices remain broadly above USD45-50 per barrel. Valuations generally remain reasonable, especially on the back of the correction since the start of the year. The growth theme is clearly the shale oil story, where both producers and services companies look well positioned—whatever the oil price, shale oil producers will remain the relative winners. Among ‘the rest’ of the oil sector, the large integrated oil majors look the most attractive investment opportunity, albeit not a growth category but more a yield story.

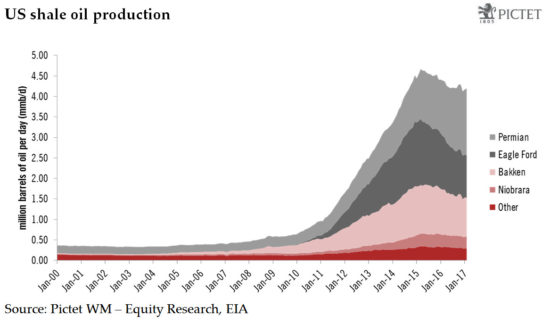

The shale oil industry was hit hard by the price slump of the past two years, but the survivors have shifted downwards on the cost curve, thanks to efficiencies and technological progress. Over the long term, we expect further efficiencies to be realised. As a result, US shale output may rise by close to 1m barrels per day (b/d) over the next few years, enough to meet the bulk of global demand growth (1.3m b/d). Across the industry, most companies are positioning for ‘lower-for-longer’ oil prices.

High-risk exploration is now a story of the past. The deep-water theme has been perhaps the most impacted—it is not completely dead, but the market is set to be around half the size of what seemed likely previously. Canadian oil sands will garner little investment from international oil companies. Meanwhile, consolidation is under way in the oilfield services industry, in order to bring down costs by offering new integrated solutions.

Shale oil has forced the conventional oil industry to reinvent itself. Companies have nevertheless demonstrated terrific powers of adaptation. This has been possible thanks to the high-tech nature of the oil industry, which allows companies swiftly to adapt their business models. In 2017, shale oil companies, or US E&P’s (exploration & production), will be in return-to-growth mode after a period of declining volumes. International majors meanwhile have hit a sweet spot that is likely to extend over the next few years—they are harvesting the huge investment made over the last five years, which is now delivering growth.