GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.At a country level, France and Spain are the first of the big four euro area economies to have published Q3 GDP figures. In France, real GDP increased by 0.5% q-o-q in Q3, while it rose by 0.8% in Spain.The French number implies that 2017 annual GDP growth is likely to be in line with the government’s new forecast of 1.8% , providing a welcome boost to fiscal revenues at a critical juncture.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB inflation projections, euro area core inflation, euro area GDP, euro area growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

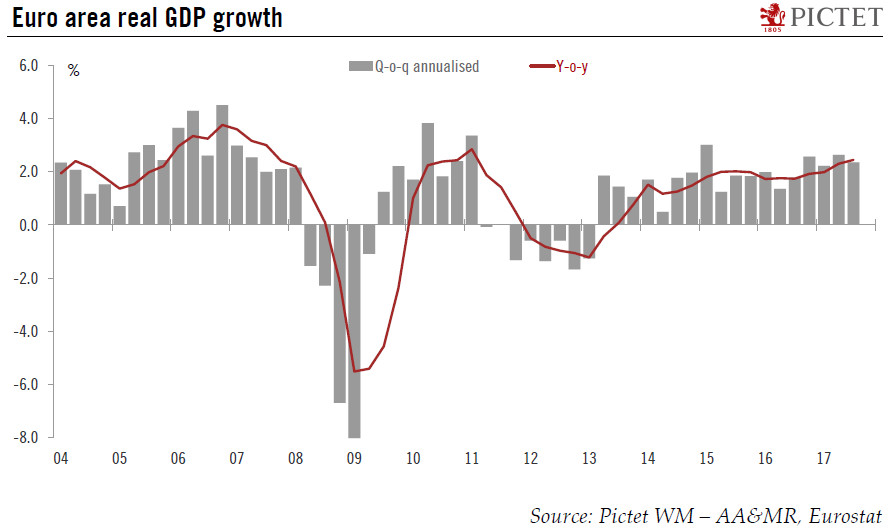

GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.

According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.

At a country level, France and Spain are the first of the big four euro area economies to have published Q3 GDP figures. In France, real GDP increased by 0.5% q-o-q in Q3, while it rose by 0.8% in Spain.

The French number implies that 2017 annual GDP growth is likely to be in line with the government’s new forecast of 1.8% , providing a welcome boost to fiscal revenues at a critical juncture. Our real GDP forecast for Spain (3.1% 2017 and 2.5% in 2018) is being left unchanged, with risks tilted to the downside given recent political uncertainty. The slowdown expected in 2018 is mainly due to the diminished impact of factors that supported activity in 2015-16, such as low oil prices and expansionary fiscal policy.

In the euro area overall, leading indicators remain consistent with a strong and stable expansion of the economy, if a tad slower than in the first half of this year. As a result, we are keeping unchanged our GDP forecasts of 2.1% for 2017 and 1.7% for 2018, with some residual upside risks.

Given very strong activity data, the large drop in euro area core inflation in October, to a rate of 0.9% y-o-y from 1.1% the previous month, came as an unpleasant surprise.

We are not too worried yet since early evidence points to an outsized negative contribution of services inflation in Germany and in Italy. We continue to forecast a gradual rise in euro area core inflation in the months ahead. Still, upcoming inflation releases will warrant very close monitoring, including the final October HICP report and ‘super core’ measures.

We expect the ECB to continue to focus on various measures of underlying price pressure, several of which have improved recently. But, core inflation needs to rebound in the next few months for the ECB staff to avoid downgrading their projections in December.