The USD has recovered against the euro of late, but the greenback could soon run out of steam.The US dollar has appreciated against the euro since 8 September and is getting close to our short-term forecast of USD1.15 per EUR. This recovery has been mainly driven by supportive US data, monetary policy divergence and hopes of tax reform.In the short term, robust US economic activity, a Fed that is still in rate-hiking mode and the still broadly negative sentiment surrounding the US dollar (as highlighted by elevated short USD speculative positions in the futures markets) may favour further strengthening of the greenback.However, our scenario of only a symbolic tax cut and of US activity that remains tepid in 2018 should eventually act as a headwind for the greenback. Furthermore, given

Topics:

Luc Luyet considers the following as important: Currency forecast, Dollar weakening, Euro strengthening, Macroview, USD euro exchange rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The USD has recovered against the euro of late, but the greenback could soon run out of steam.

The US dollar has appreciated against the euro since 8 September and is getting close to our short-term forecast of USD1.15 per EUR. This recovery has been mainly driven by supportive US data, monetary policy divergence and hopes of tax reform.

In the short term, robust US economic activity, a Fed that is still in rate-hiking mode and the still broadly negative sentiment surrounding the US dollar (as highlighted by elevated short USD speculative positions in the futures markets) may favour further strengthening of the greenback.

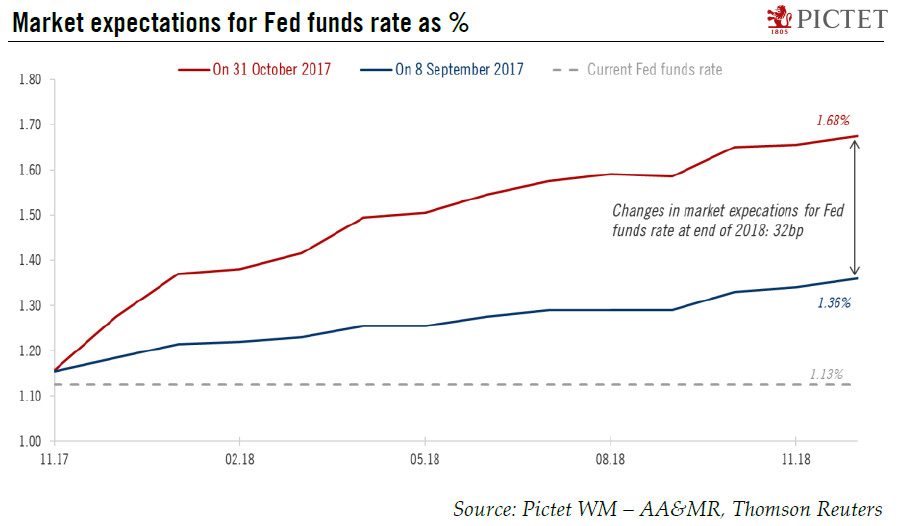

However, our scenario of only a symbolic tax cut and of US activity that remains tepid in 2018 should eventually act as a headwind for the greenback. Furthermore, given that we expect only one rate hike in the US in 2018 and given that the ECB’s forward guidance on rates is now well discounted by markets, monetary policy divergence is unlikely to lift the US dollar significantly higher. Finally, we see the risk associated with political uncertainty in Spain as remaining contained.

Consequently, the EUR/USD rate seems unlikely to move much below USD1.15, while our 12-month scenario still points to a move towards USD1.24 based on weakening US activity, subdued US core inflation and ongoing ECB normalisation of its monetary policy. Given our more constructive view of the euro relative to the US dollar in the next 12 to 18 months, the risk-reward for holding long USD positions against the euro seems unattractive, in our view.