While its persistent weakness leads us to change our short-term forecast for the franc, our outlook for the currency next year remains unchanged.The Swiss franc remains weak, notably against the euro, despite geopolitical tensions, elevated political uncertainty in Spain and some euro weakness relative to the US dollar. This means that the unattractiveness of the franc (based on its high valuation and low yield) outweighs its defensive features.In the short term, given interest rates differentials, we see scope for further downward pressure on the franc. Consequently, we need to change our short-term forecasts for the franc. Our new 3-month forecasts for a rate of CHF1.18 against the euro (compared with CHF1.16 on 27 October) and CHF1.03 against the US dollar.However, our 12-month

Topics:

Luc Luyet considers the following as important: Macroview, Swiss currency trends, Swiss franc depreciation, Swiss franc outlook, Swiss National Bank policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While its persistent weakness leads us to change our short-term forecast for the franc, our outlook for the currency next year remains unchanged.

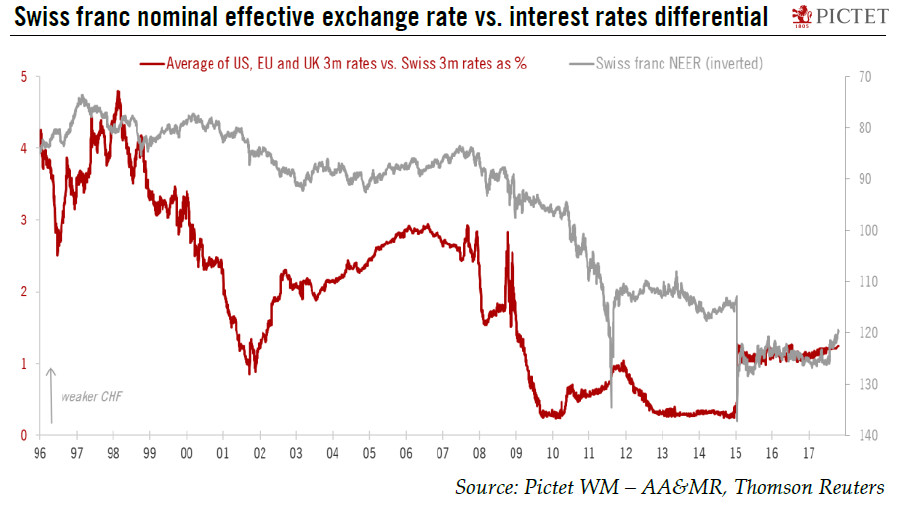

The Swiss franc remains weak, notably against the euro, despite geopolitical tensions, elevated political uncertainty in Spain and some euro weakness relative to the US dollar. This means that the unattractiveness of the franc (based on its high valuation and low yield) outweighs its defensive features.

In the short term, given interest rates differentials, we see scope for further downward pressure on the franc. Consequently, we need to change our short-term forecasts for the franc. Our new 3-month forecasts for a rate of CHF1.18 against the euro (compared with CHF1.16 on 27 October) and CHF1.03 against the US dollar.

However, our 12-month forecasts remain unchanged at CHF1.16 per EUR and CHF0.93 per USD.

First, although the Swiss National Bank (SNB) has moved aggressively to lessen the attractiveness of the Swiss franc up to now, we see scope for some normalisation in its stance in 2018. As the franc is now less overvalued than before (a fact acknowledged by the SNB itself in September), the rationale for its intervention in the market has waned.

Second, interest rates differentials should turn less negative for the franc during 2018. Our expectation is that there will be a sole Fed rate hike next year, that the ECB will not raise rates next year, and that a poor UK economy will constrain the Bank of England’s attempts to tighten policy. By contrast, we believe the SNB is likely to raise rates in 2018 as GDP growth accelerates. Furthermore, our expectation for some moderation in global economic activity could make the safe-haven franc somewhat more attractive again and reduce capital outflows from Switzerland.

Overall, the recent factors that have helped weaken the franc (reduced political uncertainty, a strong global economic recovery, a very accommodative SNB) should abate in 2018, allowing the structural Swiss current account surplus to reassert its impact on the franc.