While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening of Italian spreads over Bunds by end-2018, while Spanish spreads could remain around their current level.This forecast is based on our analysis of three relevant factors: monetary policy, the business cycle and politics.Starting with monetary policy, the ECB’s exit from QE should be very gradual, as it

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Euro periphery bonds, Italian bond, Macroview, Periphery bond spreads, Spanish bonds

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.

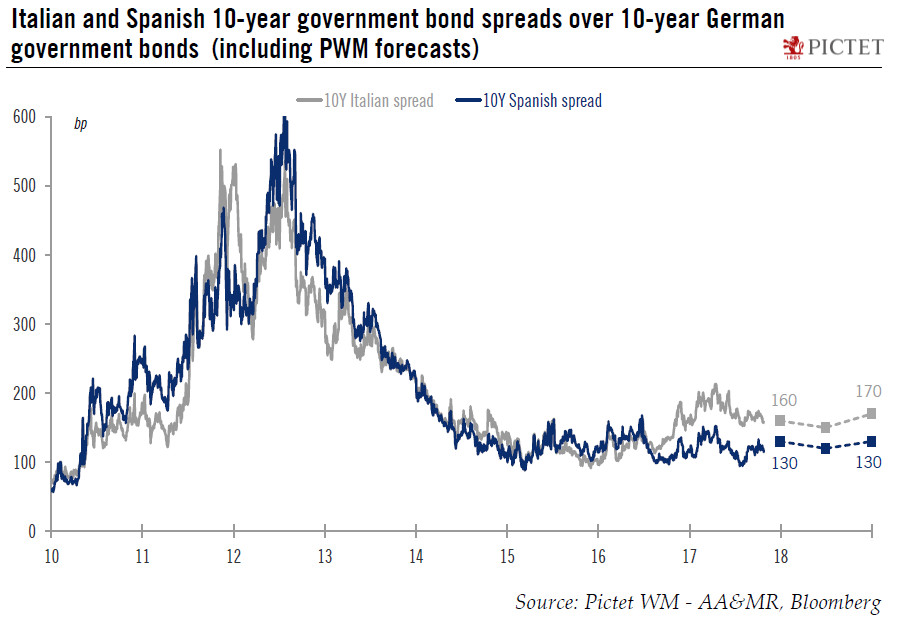

Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening of Italian spreads over Bunds by end-2018, while Spanish spreads could remain around their current level.

This forecast is based on our analysis of three relevant factors: monetary policy, the business cycle and politics.

Starting with monetary policy, the ECB’s exit from QE should be very gradual, as it absolutely wants to avoid creating turmoil — particularly in peripheral countries. Moreover, the ECB will continue to reinvest maturing debt in 2018, thereby ensuring large buying flows in the market. However, after QE comes to an end, by early 2019 at the latest, in our view, investors could seek a higher premium on Italian government bonds, meaning that spreads widen.

As regards the business cycle, Spain has reported stellar real GDP growth in excess of 3% annually since 2015. Growth in both countries should be a bit lower next year, but it should be resilient and the underlying dynamics should remain healthy. Headline inflation should remain above 1% in both countries and support the ECB’s decision to exit QE.

However, politics could inject volatility in an otherwise calm bond market that has seen yields rise gradually this year but remain in a tight range. In Italy, volatility will inevitably stem from next year’s general election, but the chances of seeing an anti-establishment party govern have fallen slightly thanks to the new electoral law. We have revised our spread target for Italian bonds from 200bp to 160bp for end-2017 as the political landscape has become less of a worry and think that spreads could widen to 170bp by the end of 2018 due to the wind-down of QE.

We continue to expect that political turmoil in Catalonia to have a limited impact on Spanish government bonds. Hence, we maintain our initial spread target over Bunds of 130 bp for year-end, but the risk of spreads widening more will increase if the situation deteriorates. For 2018, QE tapering should not have much of an impact on Spanish spreads. Bond investors appreciate the improved debt metrics that result from strong GDP growth, leading us to expect spreads to remain around 130bp throughout next year. However, were the Catalan dispute to lead to new general elections in Spain, spreads could at some stage widen above 200bp.

All in all, alongside a 10-German government bond yield of 0.7% at end-2017 (and 0.9% at end-2018), our forecast is for the Italian equivalent to rise to 2.3% at the end of 2017 and the Spanish 10-year bond yield to rise to 2.0%. We expect the Italian 10-year bond yield to climb to 2.6% by the end of 2018 and the Spanish 10-year yield to rise to 2.2%.