Meet Marc Chandler, the intuitive photographer and founder of Marc'd Images. He joined us to detail some steps along his journey to owning his business, including his original inspiration and some challenges along the way. All this as he sees himself evolving as an individual now actively taking part in our country's electoral process, and as a man of faith.

Read More »Introduction to the Entrepreneurship Special Issue

The Austrian school of economics has been all but left by the wayside in economics (e.g., Backhouse 2000). This fate, shared with all “heterodox” approaches that do not fully comply with mainstream dogma, means Austrian theory is at best discounted by other economists. More often, and typically, it is forgotten and a relic of the past. At the same time, Austrian economics is the only school of economic thought that is well represented in the study of...

Read More »FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Swiss Franc The Euro has fallen by 0.08% to 1.0771 EUR/CHF and USD/CHF, December 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders’ summit that begins...

Read More »Swiss drones to the rescue!

Drones are widely used to take amazing aerial photos, or to inspect infrastructure and crops. But in the future it is hoped they can increasingly be deployed to help firefighters or search and rescue operations in emergency situations. Swiss researchers are at the forefront of drone research. The Swiss rescue agency REGA is testing an autonomous rescue drone to find people lost or in difficulty in the mountains. It should be operational next year. Scientists are also working on small...

Read More »WEF annual meeting moves from Switzerland to Singapore

The coronavirus pandemic has forced the World Economic Forum (WEF) to relocate its flagship event to Singapore next year. It will be only the second time in 50 years that it will be staged outside of the Swiss mountain resort of Davos. The 51st annual meeting of business, political and civil society leaders will take place in Singapore between May 13-16, WEF announced on Monday. Organisers added that it plans to return to Davos in 2022. The event has moved out of...

Read More »Swissair liquidator extracts CHF2.75 million from former bosses

Former Swissair bosses have been ordered to pay CHF2.75 million ($3 million) almost 20 years after the national airline carrier went bust. The bill has been presented to 14 former managers after many years of legal wrangling and court battles. Swissair’s liquidator announced the agreed settlement on Friday, having failed last year to hold the executives liable for the much larger sum of CHF280 million. The grounding of the 71-year-old national airline in 2001 was...

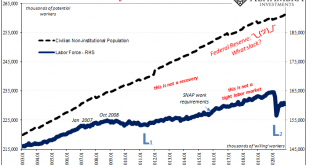

Read More »Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments. Without any jobs, let alone enough good jobs, an entire generation of Americans has been hamstrung,...

Read More »FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Swiss Franc The Euro has fallen by 0.21% to 1.0794 EUR/CHF and USD/CHF, December 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents. This, coupled with new US...

Read More »Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness. Strauss Attorneys PLLC has come up with a list of estate planning insights,...

Read More »Covid continues to stress Swiss economy

[caption id="attachment_603928" align="alignleft" width="400"] Despite some businesses being opened up again from lockdown, most are still counting the cost of Covid-19. Keystone / Laurent Gillieron[/caption] Overnight hotel stays fell by more than 40% during the summer as Switzerland locked down against coronavirus. The pandemic has also battered the finances of the airline industry, but most smaller companies have retained some optimism for the future. ...

Read More » SNB & CHF

SNB & CHF