How I Process Ideas Into Investments Investing is incredibly hard. Mapping observations to security price movements are complex. Often, the relationships governing these moves are unknown. Yet, this is the investor’s task. I’ve used this blog as a tool for exploring some of these connections. It’s been incredibly rewarding. Not only has writing brought many of my wrong ideas to light, but it refined my process for constructing an investment portfolio. I now have an improved method for mapping themes to actual concrete positions, which I’ll illustrate here. I’ve explored a broad spectrum of investment ideas over the years. I’ll admit, the applications aren’t always apparent. Take postmodernism’s influence in the markets. For example, what’s the trade there? How

Topics:

Seth Levine considers the following as important: 9.) Real Investment Advice, 9) Personal Investment, Featured, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

How I Process Ideas Into Investments

Investing is incredibly hard. Mapping observations to security price movements are complex. Often, the relationships governing these moves are unknown. Yet, this is the investor’s task. I’ve used this blog as a tool for exploring some of these connections. It’s been incredibly rewarding. Not only has writing brought many of my wrong ideas to light, but it refined my process for constructing an investment portfolio. I now have an improved method for mapping themes to actual concrete positions, which I’ll illustrate here.

I’ve explored a broad spectrum of investment ideas over the years. I’ll admit, the applications aren’t always apparent. Take postmodernism’s influence in the markets. For example, what’s the trade there? How does discussing that central banks don’t create money or that inflation is misplaced in a fiat currency regime improve my returns? Oddly enough, they have. Working through these kinds of topics helped me build an investment framework and a process for incorporating them into my portfolio.

Disclaimer

Of course, I must start with a disclaimer. The following is not investment advice. It’s merely an illustration of how I might utilize various investment themes in my investment process. These are just my personal opinions and should not be construed as investment advice or recommendations to purchase or sell any investment, product, or service; nor should this content be relied upon for making investment decisions. You all know the drill.

The Process

I take our core tenets seriously. Reason, Reality, and Investing. I firmly believe that what is should dictate how I ought to invest. Such sounds simple, but I find it anything but simple. First, it’s nearly impossible to determine what something in its entirety. Investment markets are complex systems with many degrees of freedom. Realistically, I can only place things on a spectrum of certainty. But that’s OK. I can account for this.

Secondly, it’s hard to identify potential investment themes, let alone express them in market terms. Yet, this is the essence of investing. Real-world events almost always impact capital flows, and when they are, there’s money to be made (and lost).

Finally, we must actively monitor each position once initiated. Such is arguably the most challenging part of investing. Sizing and managing positions may be the most significant return determinants.

Ultimately, there are countless ways to invest. The trick is finding something that works for you. Here’s how I’m starting to implement a process I developed through writing this blog. Please note that what you read is a work in progress. Strong views held loosely.

The steps of my process are:

- Identifying themes

- Understanding the effects

- Identifying expressions

- Identifying trade types

- Determining conviction and sizing

- Determining timeframes

Identifying Themes

I write a lot about potential investment themes. These are the significant, real-world events that (may) underpin market moves. Investment themes are distinct from trades. For one thing, they are not investible by themselves. Instead, we must break down themes into specific investments. They are merely starting points. However, a single theme may spawn many trades and persist for long periods. Themes may even overlap with other themes.

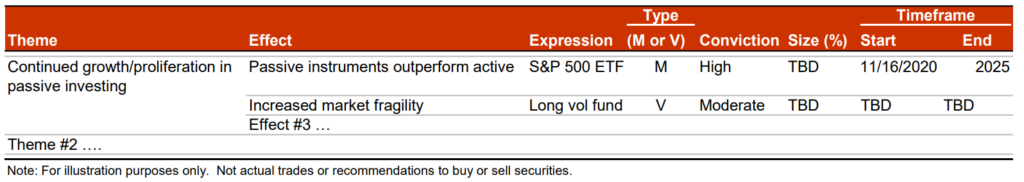

For example, one theme that fascinates me is the growth in passive investing. There are lots of potential market implications. Inflows into passive investing strategies have been growing for decades. While first an equity phenomenon, passive is now taking share from active managers in fixed income, commodities, derivatives, and even for retirement planning, to name a few. The impacts are potentially enormous, affecting the supply and demand for individual securities, relative style performance, and even the investment management business itself! As exciting as this be, you can’t trade “growth in passive investing” directly.

Identifying Effects

Once I identify a theme, I try to tease out its effects in investment markets—if any. Like themes, effects are also not directly actionable. There’s still more work to be done, but I’m getting closer to the prize.

My passive investing theme above likely has many effects. First, the proliferation of passive investing also diminishes market diversity. Such is especially true if assets under management (AUM) concentrate on a few massive players. As market diversity decreases, I’d expect fragility to increase. Such should manifest as infrequent but severe bouts of volatility amid an otherwise overly-tranquil environment.

Another effect may be that momentum strategies outperform value. The latter tends to play more prominently in active managers’ portfolios. As investors shift their assets to passive strategies, redemptions force active managers to sell. Such might cause their preferred strategies (i.e., value) to underperform since popular market capitalization-weighted passive strategies have implicit momentums components.

Like “growth in passive,” these effects need to be broken down into actual investments.

Identifying Expressions

After identifying the effect of a theme, I need to figure out how to express it in investment terms. Such sounds easier than it always is. It is also where the artistry of the investment masters is in full display.

Sometimes I can’t express my views as trades. When I can, I try to find assets that most capture the upside and limit the potential downside. In other words, I need to determine what to own, how to do, and when. I think of these in terms of collateral, leverage, and volatility. See here for an explanation of how I use these concepts.

There can be many ways to express an investment theme. Not all, though, may make great investments. Take a desired long position in gold, for example. I can buy jewelry, physical coins, bars, an ETF, futures contracts, options, gold miners, etc. My choice (and return) depends on my desired exposures to collateral, leverage, and volatility.

Identifying Trade Types

The way I see things, there are only two types of possible trades: speculating that a trend will persist or that a trend will reverse. It matters not how one makes this determination: valuation, technical analysis, or quantitative signals. Ultimately, I only care about an asset’s price, and its price can only move in two directions—up or down—or not at all.

Rightly or wrongly so, I transpose these into the investment factor nomenclature of momentum and value. I think of momentum trades as those that will continue with their current trends and value trades as those that will begin to work. In my view, both have roles to play in a portfolio. Empirical research supports this thesis.

I categorize each portfolio position as either momentum or value trade. Such provides a clearer understanding of how I’d expect them to behave. It also facilitates me having both types of investments in my portfolio. They need not all be value plays, for example.

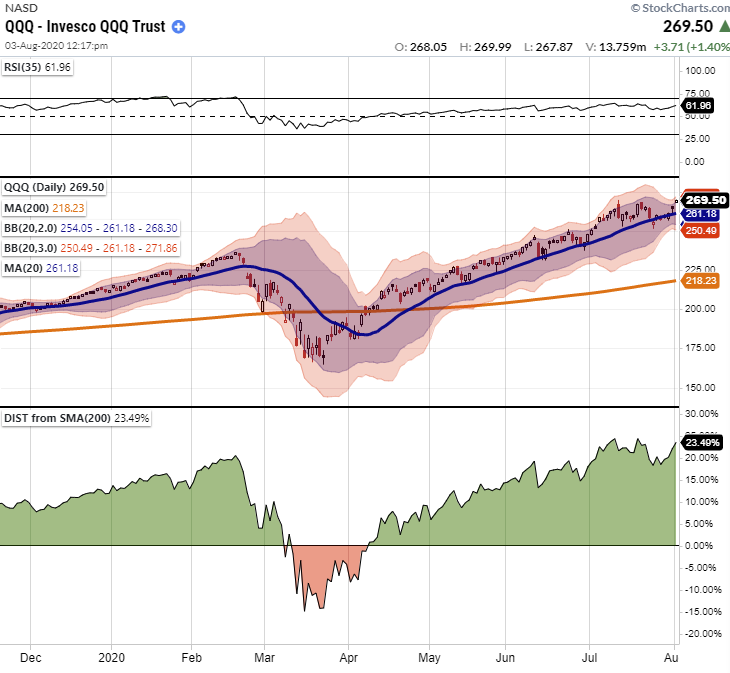

I can express my passive investment theme in terms of both momentum and value. A momentum trade could be to buy an S&P 500 index ETF (S&P 500 ETF). Persistent inflows into S&P 500 ETF could create more buying demand such that its price continues to rise irrespective of the fundamental performance of the underlying companies. One potential value-trade is a long volatility exposure. If severe bouts of volatility sporadically interrupt an overly tranquil investment landscape, volatility will periodically spike (i.e., break the low volatility trend). Being long volatility at such times would likely be profitable (and infrequent). Perhaps I could buy a well-designed volatility EFT or (more likely) invest in a fund that specializes in long volatility strategies.

Conviction, Sizing, and Timeframes: A.K.A. Position Size

Last, in my process, come the most important elements; those that relate to trade management. Though, these all boil down to position size. In the past, a conviction was a real hurdle for me. I wouldn’t invest unless I was fully convinced. I also sized every position equally and never changed them. These were mistakes that cost me plenty over the years.

I now see all investments as matters of position size. The greater my conviction, the bigger I size my trades. I also manage this size according to how events unfold. I’ll add to winning trades and reduce my losers to manage the risk of being wrong. I’m also assigning timeframes to each position to help eliminate thesis creep. If a transaction hasn’t played out over my expected time horizon, I try to reevaluate it.

Putting it All TogetherBelow are a couple of examples of how I might put this process to work. I start with my theme—in this case, the growth of passive investing. Then, I continue to break down its effects until I can express it in terms of individual securities. Last, I gauge my conviction, size my position, and assign an approximate timeframe. Not only do I find this a useful exercise for idea generation, but it also gives me documentation to review later in the trade. This illustration contains the two investment ideas previously discussed. One was purchasing the S&P 500 ETF on the premise of momentum. Such is a high conviction trade and thus should be sized accordingly (not shown in the example). The value play—investing in a long volatility fund—has not yet been initiated due to unfavorable market conditions. Note that the logical chain from theme to timeframe is all here, allowing for later analysis. |

A Process for My Framework

Abstract investment themes are much more than entertainment. They’re serious business and have roles to play in portfolios. After all, what “is” occurring in the world “ought” to influence how we invest our capital. However, this process is not always exact.

I’ve walked the reader through my method for transposing my views of the world into investment terms. To be sure, “there’s more than one way to skin a cat.” My process remains a work in progress. However, rudimentary it currently stands, I find it useful for applying reason to my best understanding of reality when it comes to investing.

The post Seth Levine: How I Process Ideas Into Investments appeared first on RIA.

Tags: Featured,Investing,newsletter