[caption id="attachment_603925" align="alignleft" width="400"] About 3-5% of the investments of 180 Swiss financial institutions taking part in a government climate compatibility test flow into fossil energies like oil, gas and coal, according to a new report Keystone / Larry Mayer[/caption] Swiss banks and retirement funds are still investing enormous sums in fossil fuel companies and thereby contributing to global warming. This is the conclusion of a...

Read More »Coronavirus, December 7: the latest numbers

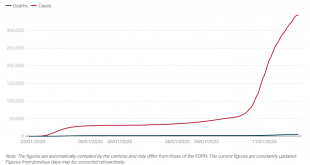

Here is an overview of the most important Swiss-related coronavirus data and graphs, which are updated automatically. How fast is the coronavirus spreading in Switzerland? We publish a series of graphs on this page, which are constantly updated as new data becomes available. This only happens once a day from Monday to Friday. The sources and the methodology behind the graphs can be found at the end of the article. In order to assess the current situation in...

Read More »Oil market outlook: Land in sight but rough seas ahead

In November, new vaccines showed great promise in fighting Covid-19, and the exhilaration was clear in markets around the world. However, the enthusiasm was not sustained. Many experts and political leaders rushed to warn that while a vaccine could mean the end of the health crisis, the economy – and oil markets in particular – are still in for a rough ride. The previous mechanism whereby the virus drove the economy,...

Read More »A Hackers Teleology by Charles Hugh Smith

"What every human wants is fairness, a chance to belong that offers everyone opportunities to get ahead by our own merit and a say when decisions are made. Even before the global upheavals, our system was failing—it wasn’t fair at all. Now that it’s unraveling, it’s time for a new arrangement that’s actually sustainable on our resource-depleted planet that doesn’t favor wealthy insiders. Hear it Here – https://bit.ly/hackersteleology Those...

Read More »This Pandemic Has Too Many Predictable “I Told You So’s”

Most of Europe is back in lockdown, presumably as punishment for our sins of going outside during the summer, and as preparation for the Christmas holidays. It feels like being back in school, where a patronizing teacher indicates that the children are incapable of behaving themselves. To some Europeans, this is a surprising development. Yet to lovers of liberty, the fact that power leads to ever-expanding power is no news. There are many “I told you so’s” in this...

Read More »Some Thoughts on a Potential US Government Shutdown

The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill. RECENT DEVELOPMENTS The Senate returned from recess Monday and the House returns today. Much of the work ahead will be done behind the scenes as lawmakers negotiate passage of an...

Read More »Don’t Really Need ‘Em, Few More Nails Anyway

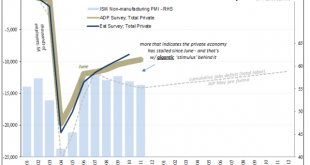

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.” Since, however, it’s been a slow downward trend that, when realizing early 2019 wasn’t exactly robust, only reconfigures the very nature of this rebound. When comparing comebacks from outsized economic contractions, the best...

Read More »The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West. There was no shortage of drama, sensationalism, half-truths and full untruths at every stage of the process, from the Democratic primaries right to this day, with politicians and partisan journalists painting their own version of reality, fueling divisions and rallying their...

Read More »The Great Reset vs. The Great Reset

In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.) COVID-19 was the ultimate ball out of left field. Yes, we knew viruses spread and pandemics were...

Read More »November 2020 – An uneventful yet expensive month

(Disclosure: Some of the links below may be affiliate links) November 2020 is over, and it was another of these 2020 months. Nothing much happened during this month because we could not see many people and several things were canceled. At least, we are both healthy. And this was the last month before we move to the new house. We are really looking forward to that. This will keep us occupied! And this will keep our mind off this boring virus. We still had to buy...

Read More » SNB & CHF

SNB & CHF