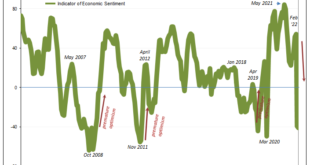

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3. It currently stands at -41.0, collapsing...

Read More »The Future of Gold and Money (Jeff Deist, James Dale Davidson, Keith Weiner, David Gornoski)

Classic roundtable from September, 2020. In this roundtable discussion, David Gornoski is joined by Mises Institute’s Jeff Deist, Keith Weiner of Monetary Metals, and James Dale Davidson, author of the Sovereign Individual. Together, they discuss the history and future of gold as an investment asset for the average Joe, general misconceptions of investing in gold, the Fiat money system, the economic effects of foreign policy, and more. VIsit A Neighbor's Choice website:...

Read More »Michael Green: Nobody Wants Jeff Snider to Win [Eurodollar University, Ep. 216]

Michael Green, professional gentleman of capital market structure, explains why US Treasury yields are rising, why options for Eurodollar future negative yields are gaining value, and why the balance of probabilities favors monetary / economic disinflation / deflation, not expansion, growth or inflation. -----SEE ALL EPISODES----- Alhambra YouTube: https://bit.ly/2Xp3roy Emil YouTube: https://bit.ly/310yisL ----HEAR ALL EPISODES----- Vurbl: https://bit.ly/3rq4dPn Apple:...

Read More »Ethereum Miner verdienen mehr als Bitcoin Miner

Auch im März war es lukrativer Ethereum zu minen als Bitcoin. Insgesamt verdienten die Miner mit dem ETH 1,34 Milliarden US-Dollar, damit sahen die Miner gegenüber Februar einen Anstieg von 7 Prozent. Bitcoin Miner verdienten im selben Zeitraum nur 1,21 Milliarden. Ethereum News: Ethereum Miner verdienen mehr als Bitcoin Miner Relativ betrachtet gab es im Bitcoin Markt jedoch 14 Prozent mehr als im vorherigen Monat. Dennoch reichte es nicht, um den ETH zu überholen....

Read More »New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe’s Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish. Yesterday, the NASDAQ fell by more than 2% for the third...

Read More »Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular. No matter where one stands on this topic and no matter how passionate one might...

Read More »Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else? What A Gold Standard Isn’t Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the...

Read More »Switzerland misses greenhouse gas reduction target

Switzerland has ambitious greenhouse gas reduction plans but has yet to implement a concrete plan to realise them. © Keystone / Gaetan Bally Switzerland has narrowly missed its target of reducing greenhouse gas emissions by 2020 despite coronavirus lockdowns and an unusually warm winter. The Alpine state had set itself the target of reducing harmful emissions by 20% compared to 1990 levels. The actual reduction was 19%, the Federal Office for the Environment said on...

Read More »The Ukraine War Shows Nukes Mean Safety from US-Led Regime Change

Some journalists like Steve Portnoy of CBS seem unable to grasp that escalations that might lead to nuclear war are a bad thing. The journalist seemed incredulous last week when asking White House spokeswoman Jen Psaki why the United States has not started a full-on war with Moscow. Psaki’s position—with which any reasonable person could agree—was that it is not in the interest of Americans “to be in a war with Russia.” Washington’s reluctance to go to war might seem...

Read More »Global Blockchain Sector Surged in 2021

2021 was a blockbuster year for the global blockchain sector, which saw funding activity surge, trading volumes balloon and further growth in key segments including custodians, exchanges, decentralized finance (DeFi), as well as non-fungible tokens (NFTs) and the metaverse, a new report by Swiss blockchain-focused investment company CV VC, in collaboration with PwC Switzerland, says. The second installment of the Global Report series, released last week, provides an...

Read More » SNB & CHF

SNB & CHF