Switzerland’s electricity supply to end-users is secured by more than 600 companies. Suppliers range from small regional utilities to international energy groups. Most of them are public sector entities. © Keystone/Gaetan Bally The government has decided to prepare a bail-out plan for Switzerland’s main electricity companies to prevent an energy shortage. The aim is to ensure financial liquidity for companies trading energy on an international scale and to avoid an...

Read More »China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics. A country once committed to quantity of economic growth above everything else would, moving forward, come to prioritize instead the quality of it. This message was a clear signal, way back when,...

Read More »PBOC Trim Reserve Requirements: Delilvers Wet Noodle after Earlier Disappointment

After posting the daily analysis, the PBOC announced a 25 bp cut in required reserves. This is said to free up around CNY530 bln or around $83 bln. It may help explain the failure to cut the benchmark Medium-Term Lending Facility. Some rural banks may see a 50 bp cut in reserve requirements. It seems like it is too small of move to satisfy expectation or address the growing economic challenges. More monetary and fiscal stimulus will be necessary to help offset the...

Read More »Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares. China disappointed most observers by failing to cut the one-year medium-term lending facility rate (2.85%) and shares slipped. The dollar is mostly higher. It is up for the 11th consecutive session against the Japanese yen. The euro fell to its...

Read More »The Biggest Threat to Our Freedom and Well-Being

There are some important things to note about the Constitution and the Bill of Rights. Our rights do not come from the Constitution or the Bill of Rights. As the Declaration of Independence states, our rights come from nature and God, not from the federal government, not from the Constitution, and not from the Bill of Rights. The purpose of the Constitution was to call into existence a government of limited powers. The purpose of the Bill of Rights is not to...

Read More »Yes, It Is Different This Time

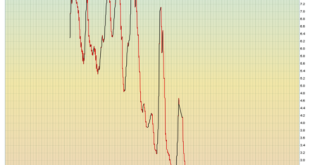

Most people would be horrified by a 40% decline in their “investments.” When bubbles pop, speculative assets don’t drop 40%, they drop 90% or even 98%. The irony of the sudden panic about real-world inflation generated by rising wages is two-fold: 1. The status quo never mentions the rampant inflation in assets, because the already-wealthy got wealthier, so asset inflation is wonderful and deserves to be permanent Look at the chart below (courtesy of Mac10) of the...

Read More »Absolute Neutralität: dringlich nötig

Viele im Westen wurden durch die Sonderoperation der Russen in der Ukraine auf dem falschen Fuss erwischt. Der seit 2014 schwellende innerstaatliche Konflikt war und ist vielen nicht bewusst. Die grundlegenden Probleme mit ihrem geschichtlichen Hintergrund, welche die Operation verständlicher erscheinen liessen, sind selbst heute den Entscheidungsträgern unbekannt. Man hat das Gefühl, dass alles, was vor dem Einmarsch passiert ist, inexistent ist. Die Einschätzungen...

Read More »Swiss Producer and Import Price Index in March 2022: +6.1 percent YoY, +0.8 percent MoM

14.04.2022 – The Producer and Import Price Index increased in March 2022 by 0.8% compared with the previous month, reaching 107.0 points (December 2020 = 100). Higher prices were seen for petroleum products in particular. Basic metals and semi-finished metal products also became more expensive. Compared with March 2021, the price level of the whole range of domestic and imported products rose by 6.1%. These are the results from the Federal Statistical Office (FSO)....

Read More »Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but Taiwan and India. ...

Read More »Staat nutzt Crypto-Börsen zur Kontrolle des Marktes in Indien und Weißrussland

Zentrale Cryptobörsen werden immer mehr zum schwachen Glied in der Kette. In Indien und Weißrussland wurde diese Woche wieder deutlich, wie der Staat die Börsen benutzen kann, um den Cryptomarkt zu kontrollieren. Crypto News: Staat nutzt Crypto-Börsen zur Kontrolle des Marktes in Indien und WeißrusslandIn Indien wurden diese Woche Einzahlungen mit Rupien auf einigen Cryptobörsen unterbunden. Zwei der größeren Börsen des Landes, WazirX und CoinSwitch Kuber, haben über...

Read More » SNB & CHF

SNB & CHF